Cracking the VC Code: lessons from the Venture Institute

From corporate venturing to venture capital—why I’m making time for growth, learning the VC playbook, and embracing the next big challenge.

Previously on Open Road Ventures: In the last episode of Venturing Insights, we analyzed key takeaways from Episode 2 of The Corporate Venturing Podcast with Philip Hague (3M). If you missed it, you can catch up here!

The Art of Balancing It All

You know that feeling when you step out of your comfort zone and suddenly realize there’s no turning back?

Yeah. That’s exactly where I am right now.

I’m in a period of my life—both personally and professionally—where I’m actively choosing to stay in the Learning and Growth Zones. Between a full-time job, this newsletter, a podcast, and now an intensive venture capital training program, my schedule is packed. But the truth is, I’m not just trying to fit things in—I’m intentionally making space for growth.

When the opportunity arose to join VC Lab’s Venture Institute, I didn’t hesitate. I knew it would be a challenge, but more importantly, I knew it would be worth it.

Selected from over 1,500 applicants, I’m now part of a global cohort—just over 200 participants from 64 countries—immersed in the intricate world of venture capital. But this program isn’t just about evaluating startups. It’s about understanding risk, building scalable investment strategies, and structuring funds that can endure market cycles.

For me, this isn’t a departure from corporate venturing—it’s an expansion. The more I learn about venture capital, the clearer the overlap becomes. What makes a great VC also makes a great corporate innovator: the ability to balance risk and reward, identify high-potential opportunities, and structure investments with long-term impact in mind.

So, what exactly am I learning?

What is VC Lab

VC Lab is the flagship program of Decile Group, dedicated to democratizing venture capital and promoting transparency in fund creation. Their mission is to make venture capital more ethical, accessible, and impactful.

A core principle of the program is the Mensarius Oath—a pledge to invest responsibly, prioritizing integrity and long-term value over short-term financial gains. Essentially, it’s the Hippocratic Oath for VCs—because the industry needs more investors who think beyond financial returns.

This program isn’t about theory. It’s a hands-on, immersive deep dive into the real mechanics of venture capital.

Lessons from the Venture Institute: Cracking the VC Code

The program is structured into sprints, each focusing on a different aspect of venture capital. So far, here are some key lessons:

Venture Capital Structures: the blueprint for success

Venture capital structures refer to the organizational models adopted by venture capital firms to manage and direct their investments. These models dictate how a venture capital firm raises, allocates, and manages the funds it invests in startups with high growth potential. Understanding these structures is crucial for aligning investment strategies with fund objectives.

📌 Takeaway: A fund is a business, not just a bank account. Set it up right from the start.

Venture Capital Processes: it’s a system, not just instinct

Great investors don’t just bet on startups—they build repeatable and scalable processes for finding, evaluating, and funding the best ones. The venture capital lifecycle follows a structured path, including crafting an investment thesis, forming a competent team, and managing a fund’s lifecycle. These processes are vital for guiding investment decisions and attracting potential investors.

📌 Takeaway: VC isn’t just about picking winners—it’s about creating a process that finds and nurtures them.

The Power Law: why one deal can make the fund

The Power Law in venture capital is a principle where one single investment yields returns larger than all other investments combined, often by orders of magnitude. Recognizing this law is fundamental for VCs to strategize and seek out potential high-return opportunities.

📌 Takeaway: VC is not about playing it safe. It’s about making a few high-conviction bets that change everything.

Venture Fund Economics: the business behind investing

Venture fund economics refers to the financial structure and incentives of venture capital funds. Central to fund economics is the 2/20 model, a compensation framework that has become emblematic of the venture capital industry. Understanding this model is essential for grasping the financial incentives and structures within venture capital funds.

📌 Takeaway: Successful fund managers aren’t just good at picking startups—they’re great at managing financial structures, cash flow, and investor expectations.

Mastering the Deal Process

The latest sprint so far focused on deal sourcing, filtering, diligence, decision-making, execution, and support. Key insights included:

The brutal realities: only a handful of deals succeed significantly; seed investing has high risk (approx. 88% failure rate), but enormous reward potential (breaking even can require a 60x return).

Good fund managers see hundreds of deals monthly yet invest in very few, reinforcing the Power Law principle.

Effective sourcing leverages deep networks, proactive scouting (accelerators, incubators, demo days), and strategic use of technology, including AI-driven tools.

Successful deal selection demands rigorous diligence—assessing team quality, unique value propositions, scalability, market potential, and competitive advantages.

📌 Takeaway: Great VC investing is about identifying and backing undiscovered gems amidst a sea of noise.

Why this matters for Corporate Venturing

What does all this have to do with corporate venturing?

A lot.

Corporate VC funds often struggle with long investment timelines and high uncertainty. Understanding VC structures and fund economics can help bridge that gap.

Unlike independent funds, corporate venture arms must align investments with strategic goals—but the best ones still operate with VC-like discipline.

The Power Law applies to corporate innovation too—most experiments fail, but the right bet can transform an entire company.

📌 Takeaway: Corporate innovators who think more like VCs will make smarter, high-impact investments.

P.S. My personal time management advice:

Balancing multiple responsibilities effectively has taught me some practical skills:

Plan your day the night before: personally, I use Apple’s Tasks as a crucial ally.

Use a calendar rigorously: schedule tasks and appointments diligently.

Prioritize tasks strategically: focus on what matters most.

Set strict time limits: avoid over-investing in any single task.

Regularly reflect on progress: adapt plans continuously as needed.

📌 Advice: If you're considering taking on significant challenges, ask yourself, "Is this worth making time for?" For me, it's an unequivocal yes.

Investing in the future—In every sense

Venture capital isn’t just about writing checks. It’s about backing the right ideas, taking calculated risks, and thinking long-term. And that applies to investing in startups just as much as it does to investing in yourself.

Right now, I’m all in.

This program isn’t just theory—it’s a real-time, hands-on sprint into how venture capital actually works. And if all goes well? It could lead to a temporary residency at a VC firm, where I can take everything I’ve learned and put it to the test in the real world.

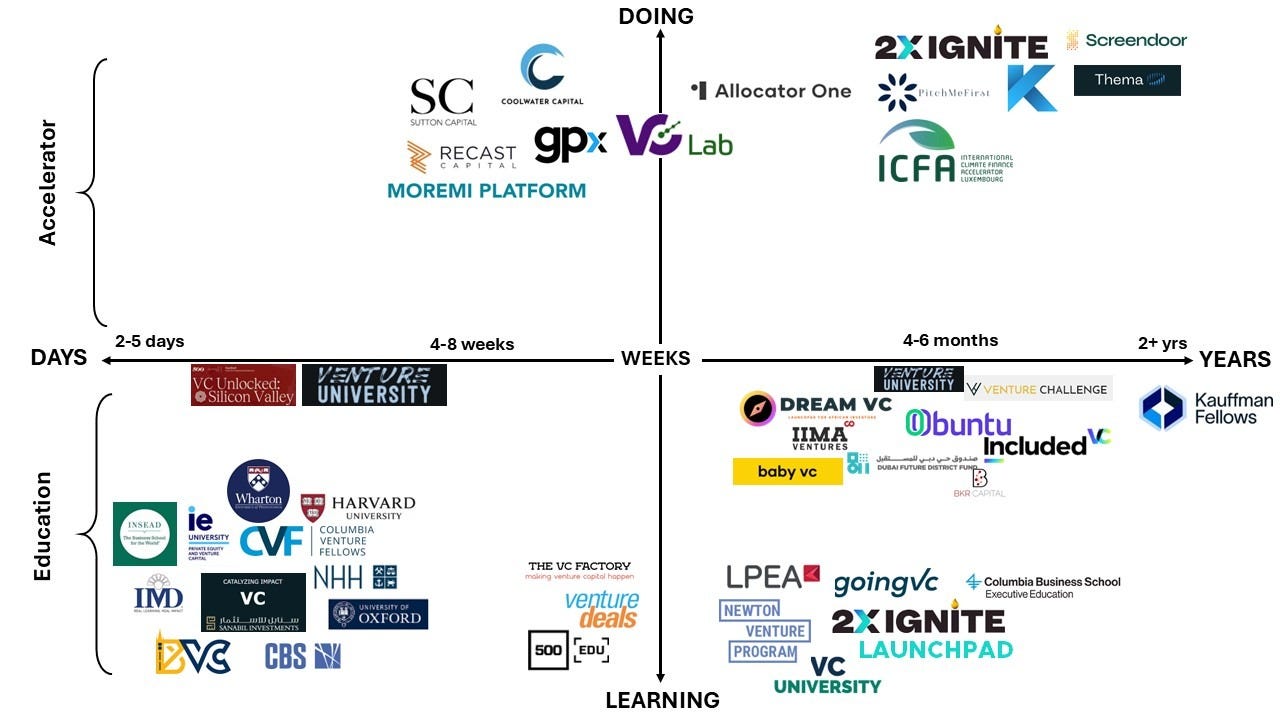

For anyone serious about breaking into VC, VC Lab’s Venture Institute is a game-changer. It’s intense, it’s demanding, but it’s also one of the few programs that truly equips you to launch and run a fund. Whether you’re an operator, an angel, or just someone looking to get their foot in the door, this is where you level up.

The journey’s not over—it’s just getting interesting.

Are you thinking about getting into VC? Let’s talk. Drop a comment or DM me—I’d love to swap notes.

As usual, a soundtrack for you: