☕️ Innovation Espresso #22

AI is changing the way Silicon Valley builds startups, CVC reputation, CB Insights’ latest report, and the usual shots of corporate venturing news!

Welcome to Innovation Espresso, a quick yet powerful dose of curated news, articles, videos, reels, newsletters, and podcasts that I’ve found particularly interesting throughout the week. While I focus on Open Innovation and Corporate Venturing, you’ll find this quick yet potent dose covers more ground. Enjoy with your morning coffee!

💊 Innovation Pills

• 🎧 Spotify is making a big AI bet—now you can listen to AI-narrated audiobooks.

• 📱 The Humane AI Pin is already back from the dead. Here’s why.

• 🏆 The Turing Award goes to AI pioneers—but they’re also warning us about its dangers.

• 📌 Trello’s 2025 redesign is here, and it’s more than just a facelift.

• 🛑 Microsoft is killing Skype—end of an era?

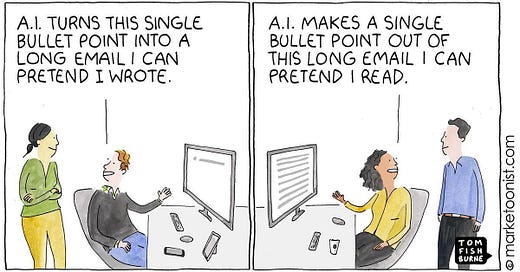

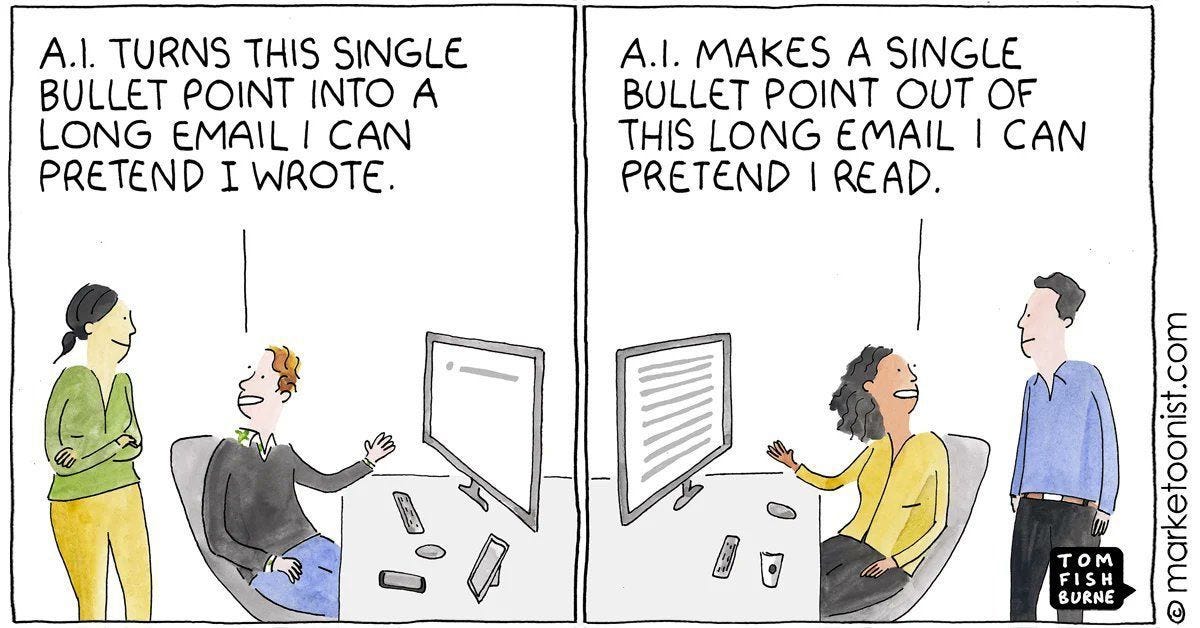

• 🤖 AI is changing how Silicon Valley builds startups.

• 🎙️ YouTube reveals 1 billion users now engage with podcast content—a new era for video podcasts?

☕️ Your weekly sip of Corporate Venturing News

🛒 Cencosud Ventures: Advocating for Corporate VCs as Startup Customers

Many corporate VCs struggle with one of the biggest paradoxes in venturing: how to be both an investor and a business partner. José “Pepe” Pascual, head of Cencosud Ventures, believes CVCs should actively become customers of the startups they invest in. Instead of just providing capital, he argues that corporates can create true value by integrating startups’ innovations into their operations. This approach ensures startups get revenue and real-world validation while corporates gain an edge in innovation. It’s a strategy that aligns incentives on both sides and could redefine the role of corporate VCs in startup ecosystems.

Note: Stay tuned for our upcoming podcast featuring an in-depth conversation with José “Pepe” Pascual.

🌟 The Crucial Role of Reputation in Corporate Venture Capital

Unlike traditional venture capital firms, corporate VCs aren’t just competing for deals—they’re also competing for trust. Reputation plays a massive role in whether startups want to work with CVCs—and whether parent companies continue to support them. A recent analysis shows that reputation can account for up to 35% of a company’s market capitalization, underscoring its importance. For CVCs, a strong reputation helps attract top startups, gain credibility in the investment community, and align with the strategic vision of their corporate parent. The flip side? A damaged reputation can mean missing out on deals, losing stakeholder support, and ultimately, venture failure.

📊 European Companies Hedging Bets in Corporate Venture Capital

Are European corporates using CVC as a hedge against disruption? A growing number of companies seem to think so. Unlike their U.S. counterparts, which often invest in bold, high-risk startups, European corporates are playing a more cautious game—spreading their investments across multiple ventures to mitigate risks. This strategy is being used to hedge against uncertainties in key sectors like energy, automotive, and AI. While some view this as a defensive approach, others argue that it reflects a more strategic long-term commitment to innovation.

🚀 Vantage Group Launches Vantage Futures

Vantage Group has entered the venture space with a bold new initiative: Vantage Futures. This program is designed to support startups working on cutting-edge solutions across industries, from fintech to sustainability. With a focus on mentorship, funding, and strategic partnerships, Vantage Futures aims to give startups the resources they need to scale effectively. The initiative signals that more large corporations are recognizing the value of direct engagement with emerging ventures, rather than relying solely on passive investments.

📈 Insights from CB Insights’ 2024 CVC Report

What’s shaping corporate venture capital in 2024? According to CB Insights’ latest report, CVCs are doubling down on AI investments, betting big on sustainability-focused startups, and increasing cross-industry collaborations. The report also highlights a shift in deal structures, with more corporate investors looking for flexible terms to balance strategic and financial returns. If you’re in corporate venturing, this report is essential reading.

📌 30 Corporate Innovation KPIs by Anton Schilling

Measuring innovation is one of the toughest challenges for corporate venture teams. Which KPIs actually matter? Anton Schilling has compiled a list of 30 key performance indicators (KPIs) that corporate innovators can use to measure success effectively. Whether you’re tracking deal flow, ecosystem engagement, or the direct impact of innovation on the core business, this guide provides a structured way to quantify innovation efforts. If you’re in corporate innovation or CVC, this is a must-read.

📹 Something to watch

Ever wondered why LinkedIn feels a bit… off? In this insightful video, the Good Work team explores why a straightforward networking platform often feels so peculiar, uncovering the psychology behind “LinkedIn cringe.”

🎧 Something to listen

In this episode of PwC’s corporate venturing podcast, the discussion centers on the CV Barometer and strategies for closing the innovation gap. A must-listen for those navigating the evolving landscape of corporate innovation.

🛠️ Something to try

If you’re tired of juggling meeting notes and struggling to keep track of action items, Granola is an AI-powered notepad for Mac that enhances your note-taking. It integrates seamlessly with Zoom, Slack, and Teams—making meetings more productive.

🤔 Did you know?

Enshittification is the gradual decline in quality of online platforms as they prioritize profit over user experience. First coined by Cory Doctorow, the term describes how platforms initially offer value, then shift their focus to advertisers, and finally, extract maximum profit at the expense of users.

🥐 Espresso is not enough?

In “Addiction Economy,” Scott Galloway explores how companies—from tech to food—strategically exploit human dopamine responses to drive engagement and revenue. A fascinating deep dive into capitalism’s love affair with addiction.

Did you enjoy this edition? Share it with anyone you like and give it a heart. Subscribe to receive it every week.

See you next week,

Davide