Inside The State of the Art of Venture Building

Just analyzed WhatAVenture’s 2025 Corporate Venture Building report. Here are my takeaways.

Previously on Open Road Ventures: in the last episode of Venturing Insights, we talked about Business Model Innovation. If you missed it, you can catch up here!

I just analyzed WhatAVenture’s State of Corporate Venture Building 2025 report on behalf of our Open Road Ventures community. The signal is clear: CVB is maturing fast.

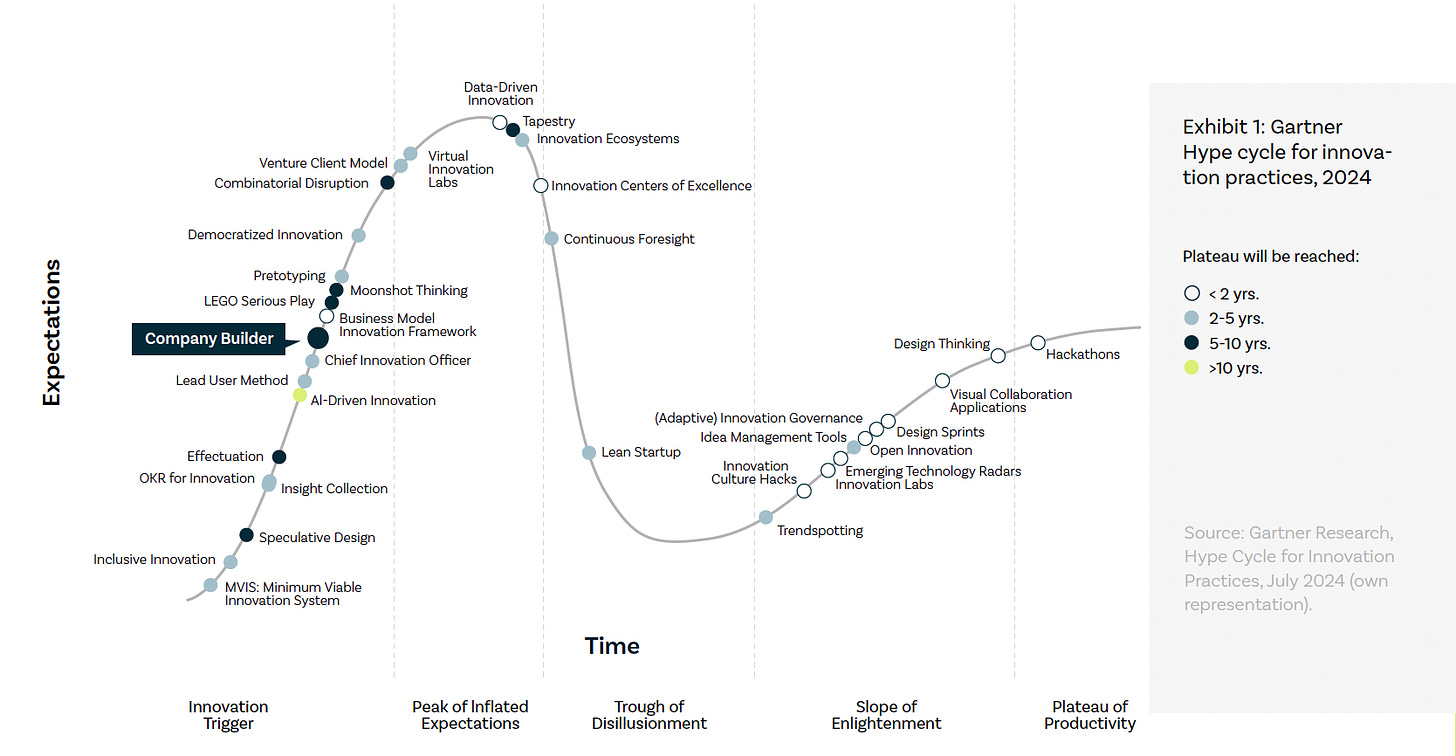

Corporate venture building, identified as an emerging trend in 2023 and 2024 on the Gartner Hype Cycle, appears to be moving past the initial hype and inflated expectations. This shift is evident in some organizations scaling back or rethinking their venture building efforts. At the same time, however, we are seeing a new wave of corporate venture building initiatives.

Forget the hype, 2025 is about governance, adjacent plays, and stage-gated funding. In this post, I’ll walk you through the most actionable, interesting takeaways for venture leaders, innovation managers, and corporate builders.

📍 TL;DR

97% of leaders say top-level commitment is make-or-break

64% of corporate venture builders operate as dedicated units

Most "successful" ventures generate <1% of company revenue—and that’s okay

The most successful CVBs fund like VCs and staff like startups

Scaling is the true bottleneck, not ideation or MVPs

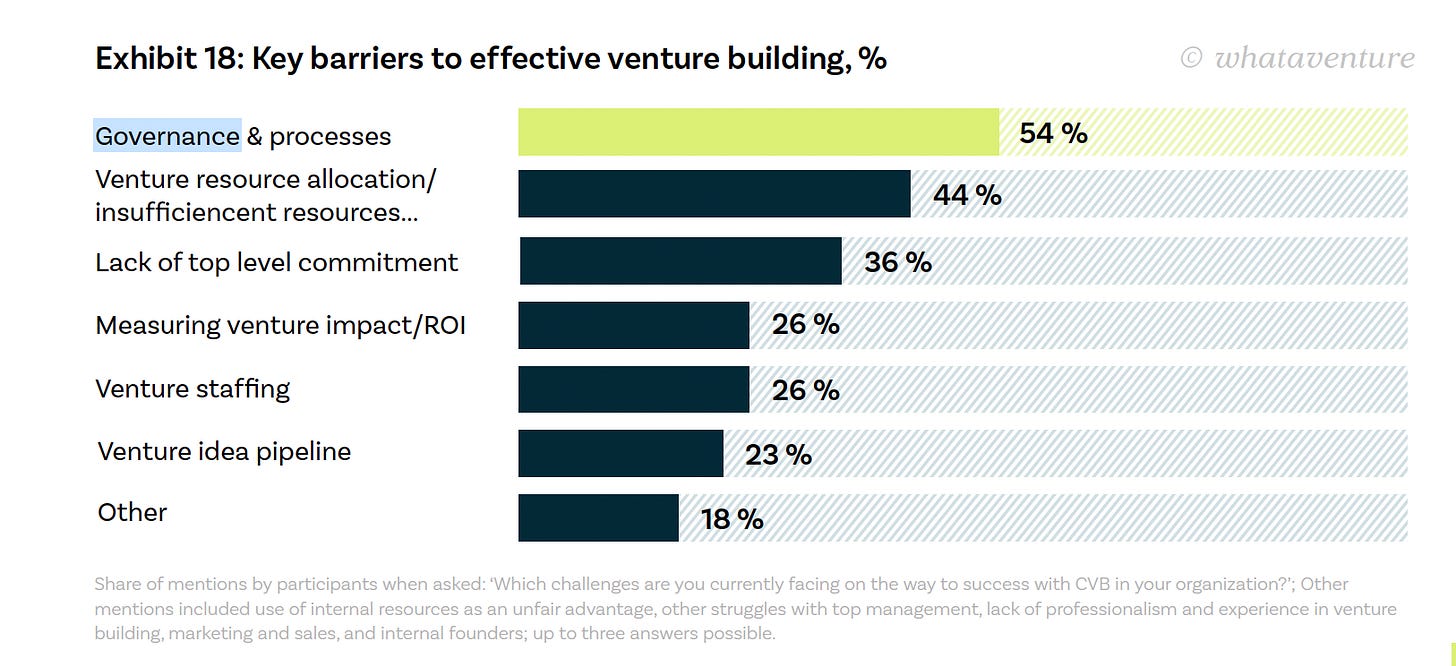

Governance and internal processes are the top barrier (54%)

VC-style, milestone-based funding is gaining traction and protecting budgets

🔍 1. From experimentation to execution

CVB is shifting into its operator era. Less moonshots, more adjacent plays.

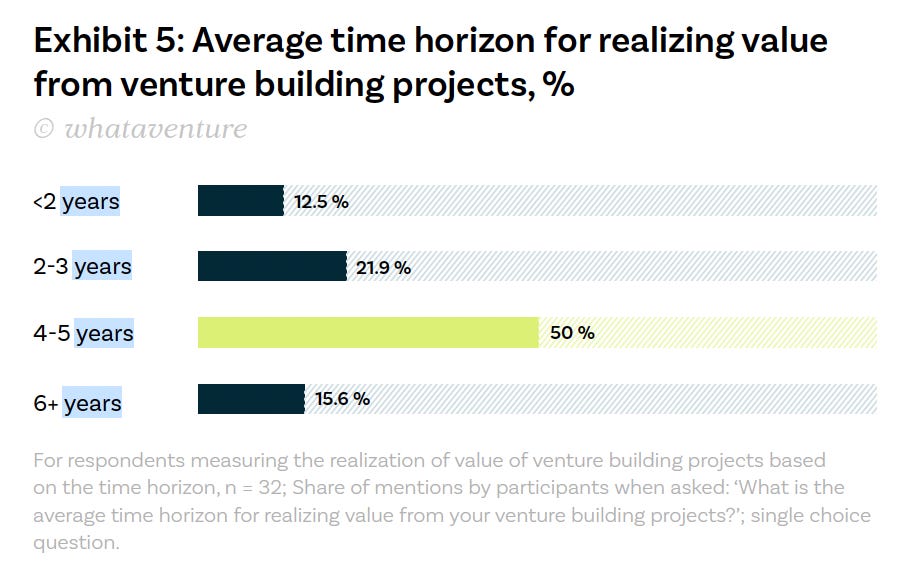

50% of respondents are having returns from CVB activities in 4-5 years.

Which is also the duration of organizational involvement of these organizations.

📊 2. Success ≠ just revenue

85% still measure ventures on revenue. But 77% of those ventures contribute <1% to corporate revenue. And 80% of the teams behind them still call them a success.

Because the real value isn’t always in sales. Strategic KPIs are gaining ground:

51% track synergies with the core

36% track innovation/IP development

Ventures can deliver:

New capabilities

Future market access

Strategic learning cycles

Anchor metrics to the intent, then evolve them.

🏠 3. The governance gap

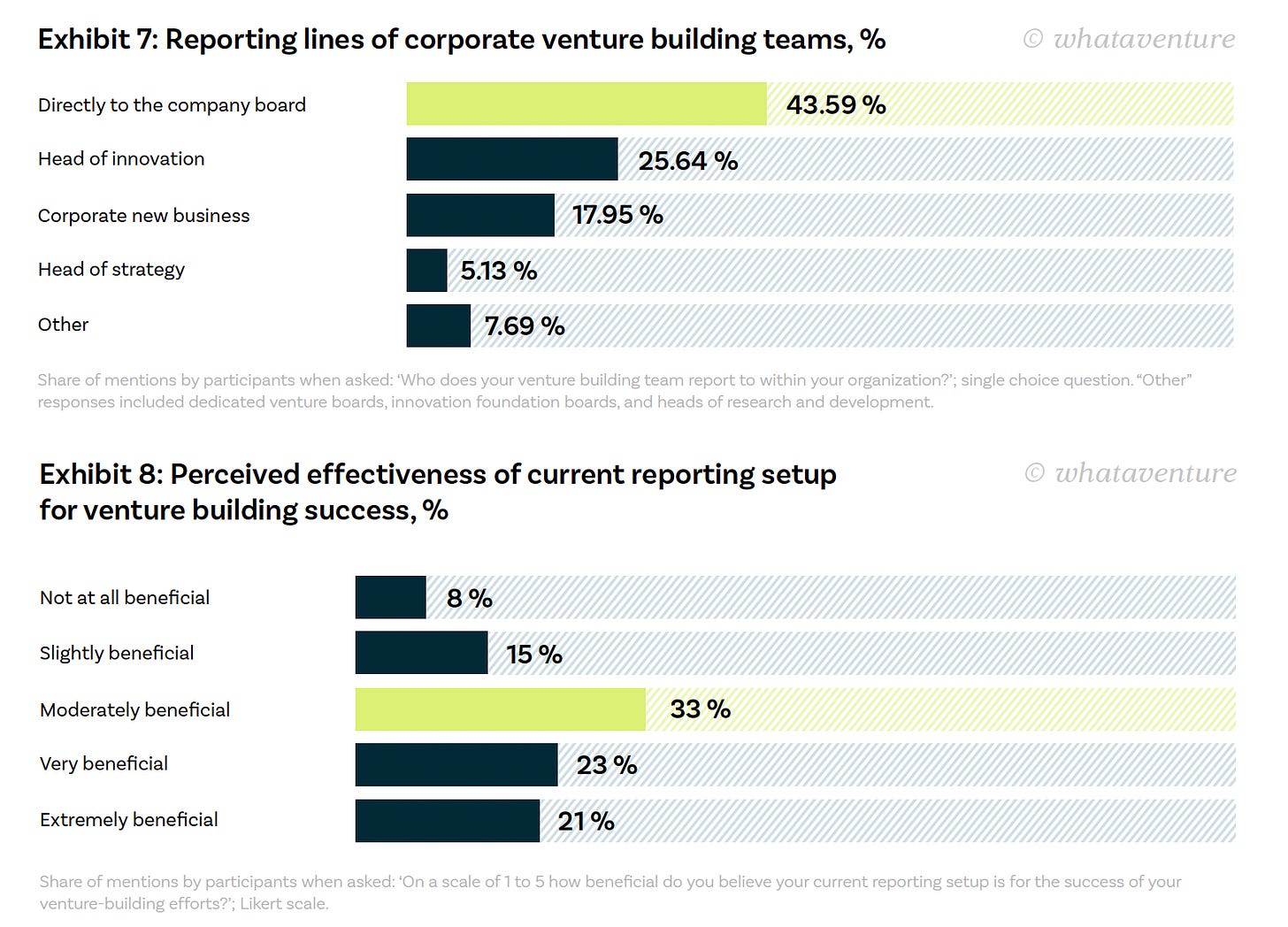

97% cite executive commitment as critical—but only 13% of CVBs call themselves highly successful.

What’s getting in the way? The most cited barrier in the report is governance and internal processes (54%).

When governance is missing, even the best ideas stall. Teams are left:

Navigating unclear mandates

Juggling fragmented reporting lines

Fighting for attention amid short-term priorities

"It’s rarely a lack of interest—more often it’s a lack of proper governance."

💸 4. Smart money = staged money

Stop funding ventures like product lines. Start funding them like portfolios.

Top CVBs adopt VC-style logic:

Stage-gated investment

Internal investment committees

Dedicated multi-year funds

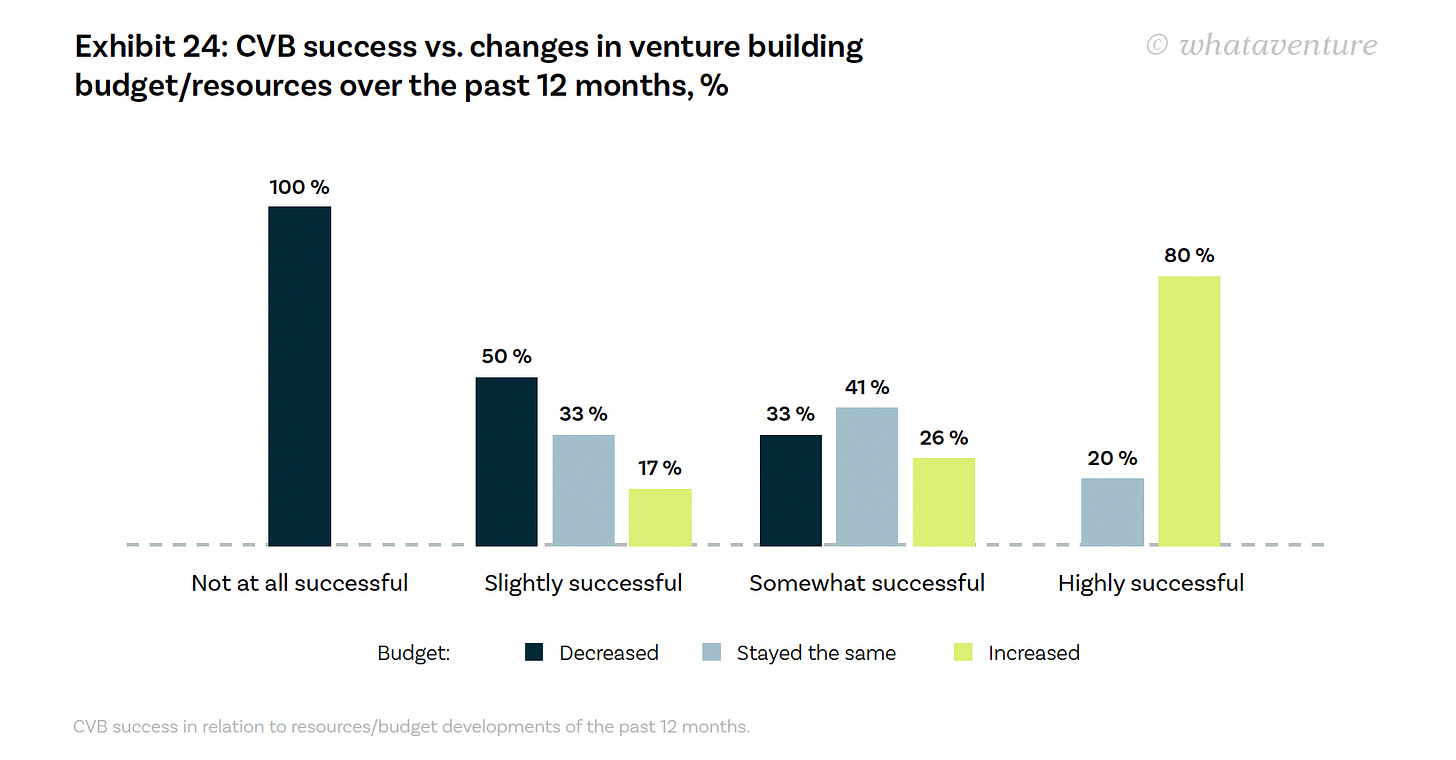

None of the highly successful teams saw their budget shrink last year. That’s no coincidence. VC-style funding enables speed without waste—and protects ventures from shifting priorities.

👥 5. Staffing for traction, not just validation

The best ventures are not built by whoever is available. They're built by:

Entrepreneurs during validation

Managers during scale

External partners when speed or precision matters

41% of CVBs outsource at least one service, rising to 76% among structured teams.

Expecting internal teams to do it all is a trap. Skill-matching beats headcount.

📈 6. Scaling is the hardest part

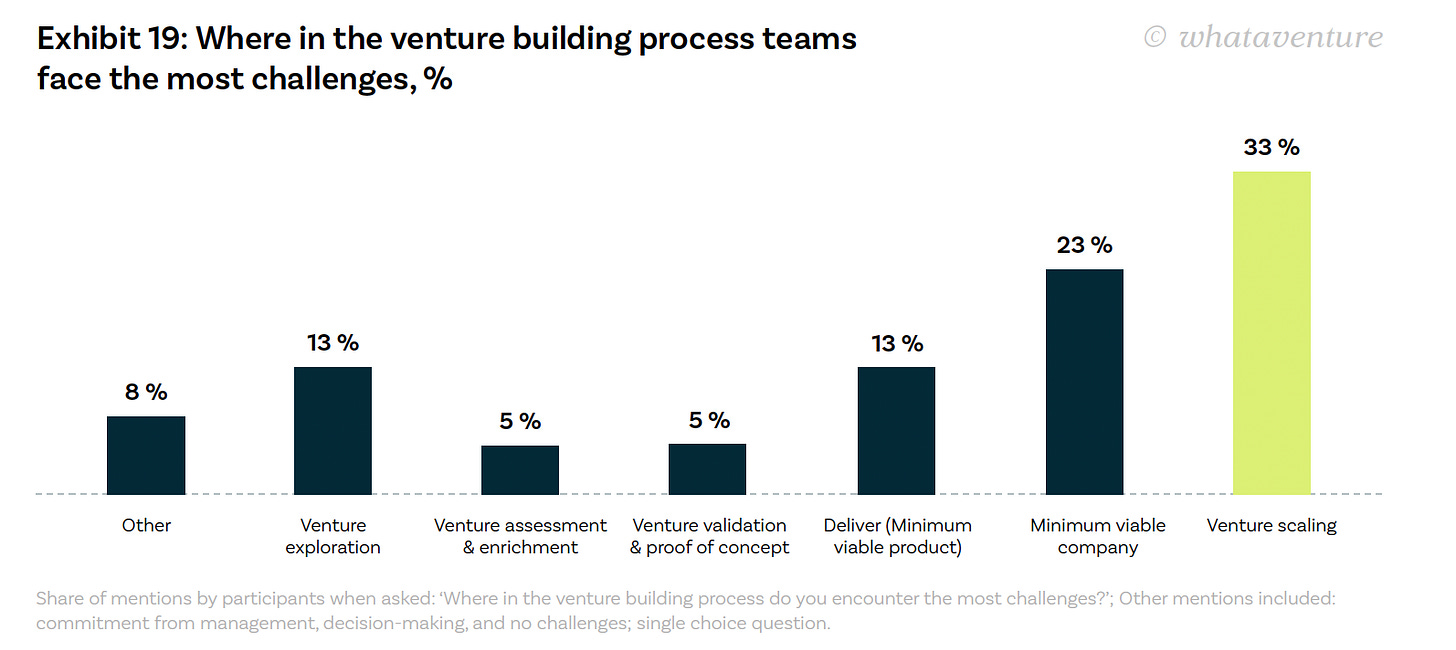

33% of CVBs say scaling is the biggest challenge. Validation is one thing. Building a sustainable business is another.

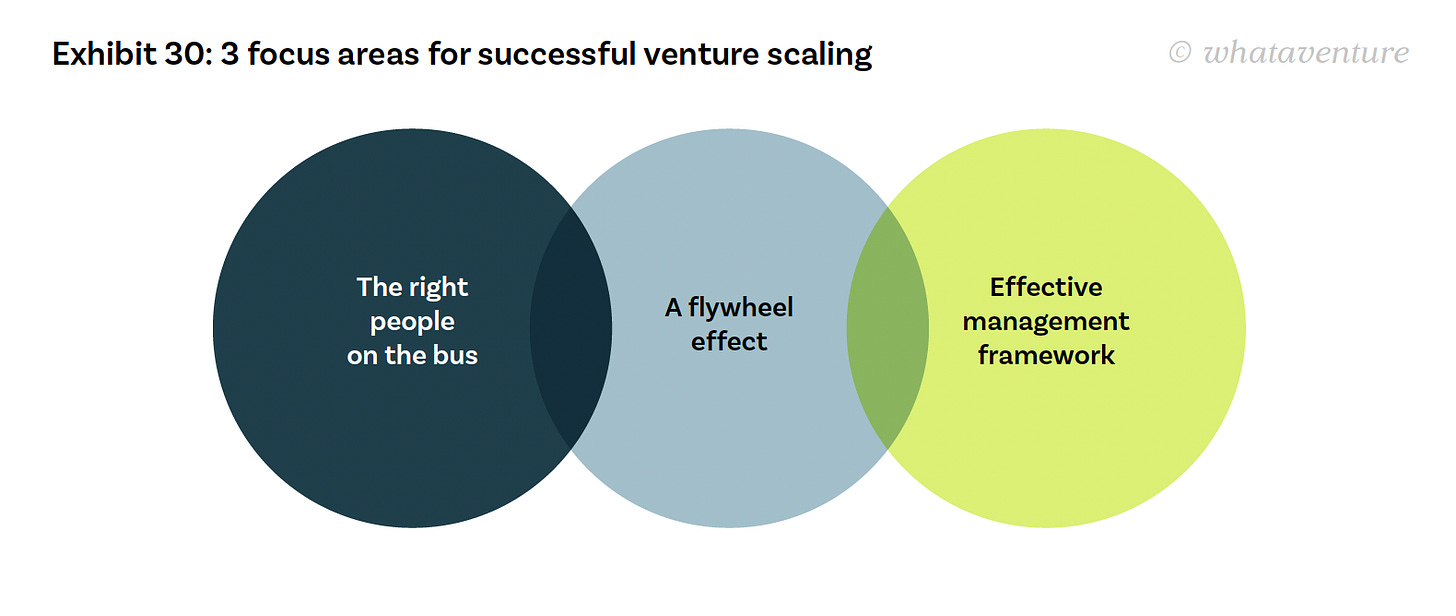

Three principles stand out:

Get the right people on the bus (experienced scale leaders)

Build a flywheel (compounding small wins)

Use a real framework (clarity, alignment, metrics)

Early wins don’t scale themselves. Structure scales.

✅ The road ahead

2025 is a turning point. The best CVBs scale with intention.

Governance. Top-Down Commitment. Talent. Stage-gated funding. Adjacent advantage.

This is how the next generation of internal ventures will thrive.

Download here the full report from WhatAVenture.

→ What’s your biggest challenge or breakthrough when scaling ventures inside a corporate? Drop a comment. Let’s sharpen the playbook together.

📣 Want to be featured on Open Road Ventures?

If you’re building a tool, service, or promoting an event in the innovation landscape, check out this page to learn how to sponsor a spot in front of 1,150+ engaged innovators. Let’s brew something great together!

As usual, a soundtrack for you: