The Corporate Venturing Matrix 2.0 by Frederic Pampus

As promised, here’s a deep dive into the updated Corporate Venturing Matrix: clarifying the tools, how to combine them, and what’s needed for execution.

Previously on Open Road Ventures: in the last episode of Venturing Insights, we explored the role of Superconnectors as a crucial driver of innovation. If you missed it, you can catch up here!

Corporate venturing is a critical driver of business growth. Companies build new businesses, acquire startups, invest in external ventures, and partner with innovators.

However, when these initiatives operate in silos, they fail to generate strategic value. Ventures stall, acquisitions struggle with integration, and investments lack alignment with core business objectives.

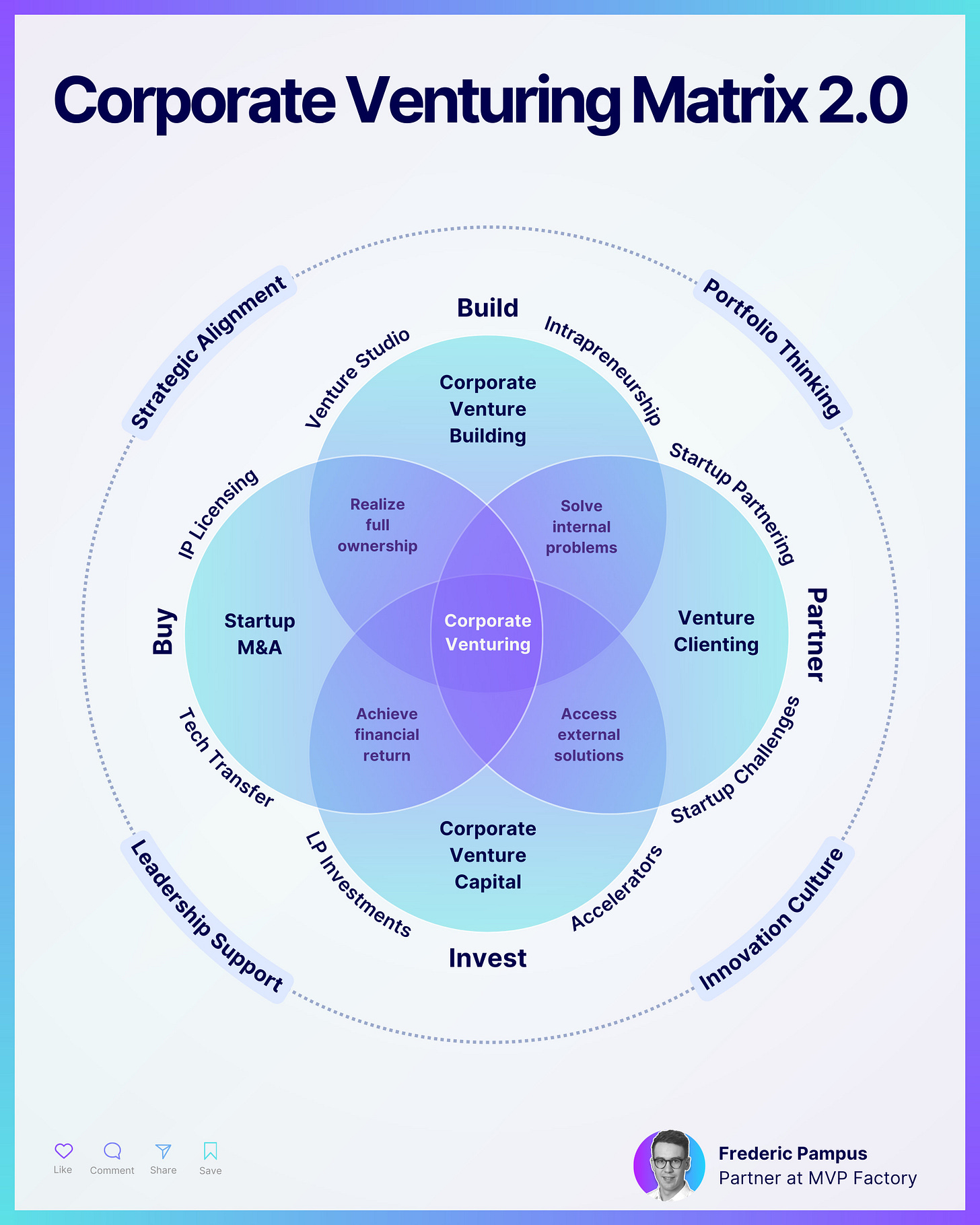

The Corporate Venturing Matrix 2.0, developed by Frederic Pampus (MVP Factory), structures corporate venturing into four core approaches: Build, Buy, Partner, and Invest.

It links them through key enablers to maximize impact. This framework ensures corporate venturing becomes a repeatable, scalable system rather than a set of disconnected initiatives.

Thanks to Frederic for this great matrix and for collaborating on this post. More insights to come.

Four Approaches to Corporate Venturing

The Corporate Venturing Matrix 2.0 defines four primary methods for engaging with innovation. Each has distinct benefits and risks, but their strategic combination delivers superior outcomes.

🛠️ BUILD → Creating New Ventures Internally

Definition: Developing new businesses, e.g. through venture studios or intrapreneurship.

Value: Full ownership and control, yet requires significant internal resources.

🛒 BUY → Acquiring Startups or Technology

Definition: Market entry via M&A, IP licensing, or tech transfer.

Value: Accelerates time-to-market, but introduces integration complexity.

🤝 PARTNER → Collaborating with Startups

Definition: Engaging with external innovators through venture clienting, startup challenges or co-development agreements.

Value: Rapid access to external solutions without the risks of full ownership.

💰 INVEST → Funding Startups for Strategic Alignment

Definition: Corporate Venture Capital (CVC), LP investments or accelerators.

Value: Provides financial return while securing strategic insights.

Yet no single approach is enough on its own. Real impact is created at companies who combine them to increase speed, reduce risk, and maximize returns.

For example startup partnerships work best when backed by strategic investments that ensure long-term alignment. Acquisitions have a higher success rate when companies have already engaged with startups, allowing them to validate strategic fit before committing to full ownership. Investing in external startups provides insights that shape internal venture development and ensure alignment with market trends.

A disconnected approach slows progress, while a connected strategy creates a clear path from early exploration to scaling new businesses.

Four Enablers for Execution

Corporate venturing initiatives frequently fail due to execution challenges, not strategy flaws. The Corporate Venturing Matrix 2.0 integrates four enablers to ensure tangible business impact:

1️⃣ Strategic Alignment

Venturing must tie directly to corporate priorities to secure executive sponsorship and funding. Misaligned initiatives remain experimental and struggle to scale.

2️⃣ Portfolio Thinking

A structured mix of Build, Buy, Partner, and Invest enables companies to hedge risks and adapt to market shifts.

3️⃣ Leadership Support

Governance frameworks and executive backing are critical to overcoming corporate inertia and securing autonomy for venturing teams.

4️⃣ Innovation Culture

Corporate venturing must be embedded across business units rather than confined to isolated innovation teams.

Key Takeaways

Companies that successfully implement corporate venturing do not treat Build, Buy, Partner, and Invest as independent strategies. Instead, they orchestrate them into a cohesive framework supported by execution enablers. By this, they consistently translate innovation efforts into actual business growth.

Thanks again to Frederic, and shoutout to his great work!

As usual, a soundtrack for you: