The universal pattern of technological innovations

When every innovation begins as a miracle and ends as a habit. History repeats itself: technology changes, but the pattern of its evolution remains the same.

I discovered Carlo on Substack, and I’ve been hooked ever since. His newsletter Building the Plan is one of the few that manage to make finance, business, and strategy feel like a friendly walk, never a climb. It’s sharp, insightful, and refreshingly free of buzzwords.

For my Italian readers: if you haven’t already, subscribe. Carlo deserves a much bigger audience. He writes with the clarity of someone who’s lived through the spreadsheets and stayed curious.

What is Building the Plan? It’s Carlo’s personal lab, where he breaks down corporate finance, real-world strategy, and company case studies. It’s part journal, part simulation chamber. You’ll find field notes from his role in the finance team of a major Italian industrial company, side-by-side with creative exercises like Se Fosse Mia, where he roleplays as CEO of companies he admires and maps out how he’d grow them.

There are no growth hacks or miracle formulas. Just method, curiosity, and solid thinking. If you care about the mechanics of business and want a more thoughtful way to grow your perspective, Building the Plan is for you.

This article is a perfect example. Carlo maps out a universal pattern of how breakthrough technologies evolve. Not just AI, but all the big ones: steam, electricity, the internet. It’s not just a historical timeline; it’s a mental compass. One that helps you interpret where we are, what’s next, and what decisions matter right now.

It links deeply with a few of my previous reflections, especially around the definition of innovation, the importance of framing at both micro and macro level, and the cyclical nature of corporate innovation vehicles.

And it’s especially timely now: the 2025 Nobel Prize in Economics was awarded to Mokyr, Aghion, and Howitt specifically for their work on how innovation drives long‑term growth. Their recognition underscores that understanding innovation’s dynamics isn’t just academic, it’s central to today’s economy.

But now, over to Carlo. Enjoy his article until the end.

It’s now clear we’re living through an era that is bringing the next great technological innovation to the world.

Artificial intelligence, like the great innovations of the past, will reshape the world as we’ve known it so far. I’m not saying anything you haven’t already heard or read a thousand times.

And I’m not here to repeat what anyone else could say.

My goal is just to bring order to the noise surrounding today’s debates and deep dives on this technology, and to understand, concretely, where this journey is headed, a journey that truly began on November 30, 2022, when ChatGPT was introduced to the world. (AI didn’t start there, but that’s when the world realized its magnitude.)

By nature, I try to strip away noise and focus on the core, without overweighting one opinion over another.

I need a method. I need a pattern, something I can understand and stand behind, that fits the topic and helps me make better sense of the world out there.

The invisible engine of revolutions: why some innovations change the world

Each generation “wakes up” to a new technological horizon, but only a few innovations become true General Purpose Technologies (GPTs—ironically the same acronym as OpenAI’s GPT, though it stands for Generative Pre-trained Transformer), capable of transforming entire production systems, business models, and society itself.

Classic examples: the steam engine, electricity, the internal combustion engine, electronics, computing, the internet.

And today: AI.

What unites these long waves? A recurring structure, almost a universal pattern I want to decode. The challenge is to read it early, so our understanding has a method, useful, clear, and able to support better decisions.

The six stages of the “Universal Pattern” (or, how to read the future of technology)

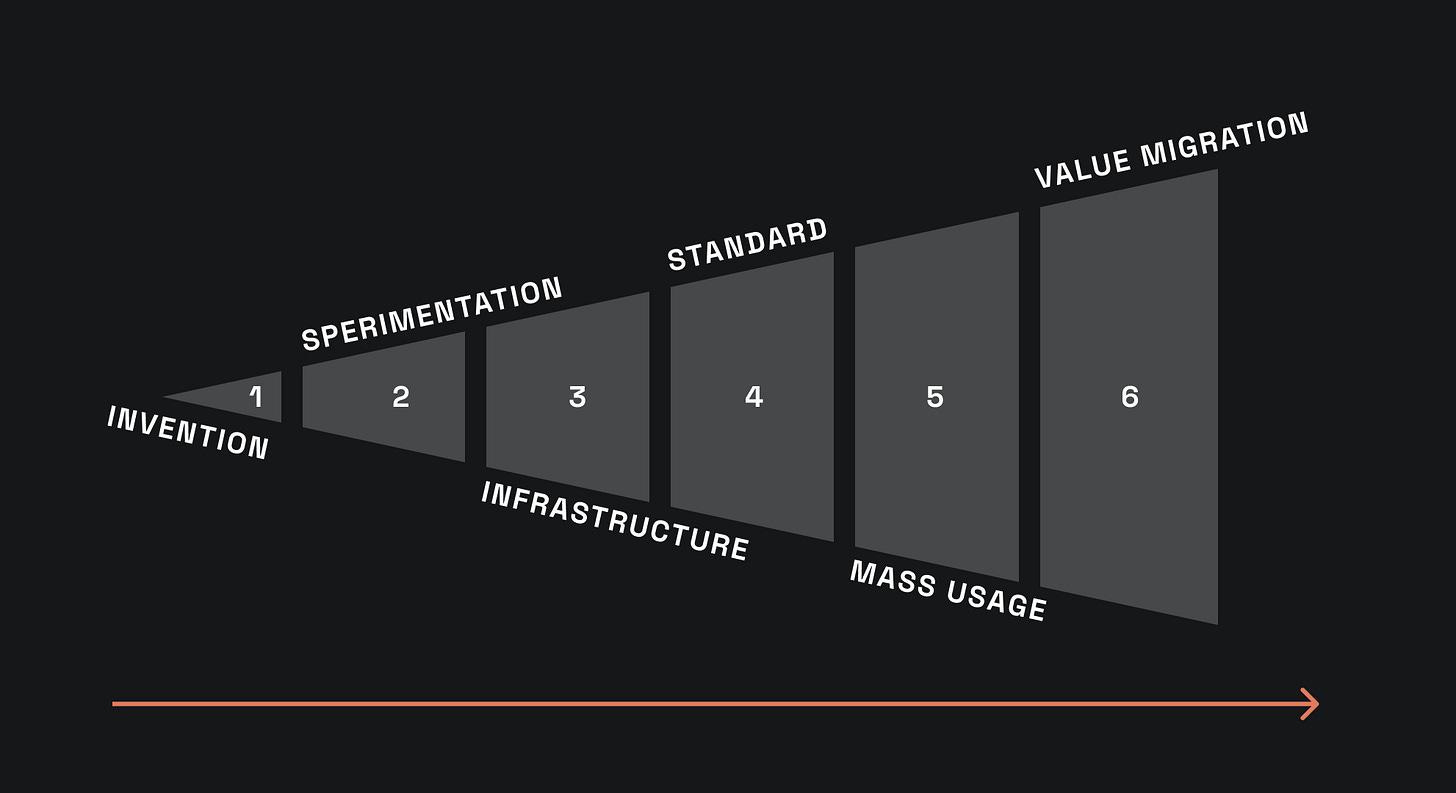

Let’s attempt a pattern: a universal framework to better read the birth, development, consolidation, and mutation of a technological innovation. Below is the concise but concrete version of my pattern, with historical examples and implications for today. It unfolds in six steps:

Invention

Experimentation

Infrastructure

Dominant Standard

Mass Adoption

Migration of Value

It blends visions and approaches from many sources. I’m not claiming to have invented or theorized a pattern. But this is helping me understand the dynamics of a technology, the AI, that many seem to think is already fully internalized and understood.

Well, not me. At all.

1) Invention

It all begins in a moment of genius and solitude. A dimly lit lab, a messy desk inside a warehouse, or better yet, a garage, like in the great Silicon Valley stories. On the table, a prototype that almost never works. It’s the phase when no one really believes in the idea, but someone insists anyway. Often, the idea emerges from combining existing elements that had never before been put together. Other times it’s the discovery of something new. Either way, it’s disruptive.

I like to think the technologies humanity will see a century from now are already among us. We just can’t see the combinations that will bring them to life.

Consider movable-type printing, a technique that reproduced text on paper more quickly and easily than handwriting. It was invented in China by Bi Sheng and later took root in Europe thanks to Johannes Gutenberg, the German printer who first transformed writing on the continent. It was, essentially, a combination of elements already at hand: a mechanical press and oil-based inks used in painting. A combination as simple (in hindsight, of course) as it was revolutionary, one that enabled the reproduction of knowledge, literacy, modern science, the ideas that shaped the world, and the spread of learning.

Think of James Watt and the steam engine, the protagonist of the First Industrial Revolution, combining vacuum pressure concepts with pump mechanisms used in mines.

It wasn’t a single flash of insight, but the result of roughly a century of research. Once invented, the steam engine opened a new epoch: trains “hurtling” along at 22.5 kilometers per hour.

Nadeije Laneyerie-Dragon — The Wonder of the Steam Engine.

2) Vertical experimentation and the appearance of inefficiency

Then comes the moment when the first companies “dare”.

During the Second Industrial Revolution, mechanical factories began introducing electric motors into production. At first there were no clear benefits. Costs were high and efficiency was so low that people wondered whether any of it made sense.

Then someone re-architected the entire workflow around the new technology, and productivity exploded.

That’s exactly where we are with AI today: automated call centers, medical diagnoses supported by models, CFOs asking a copilot for insights. These are vertical tests. Experiments. And they’re already working.

Partially.

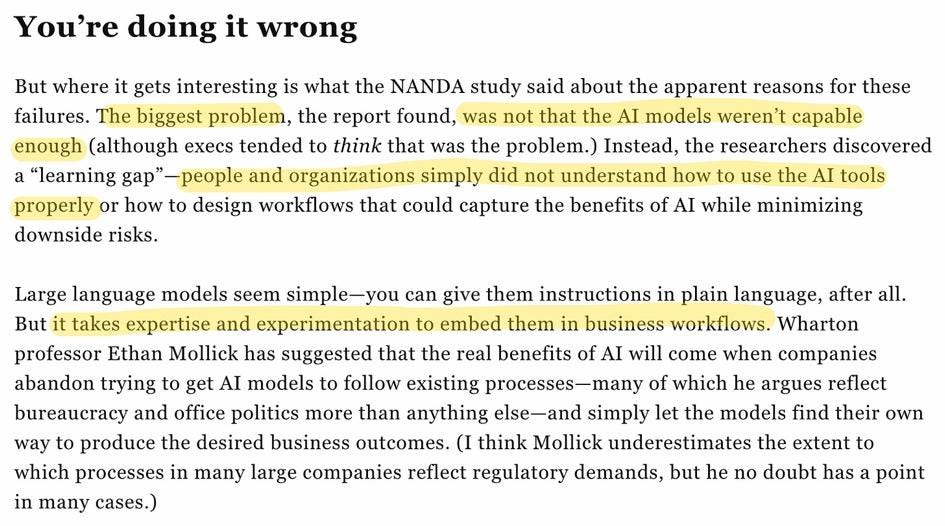

In 2022, the authors of “The Fallacy of AI Functionality” argued that many AI systems don’t truly “work”: algorithms flagging non-existent fraud, facial recognition models making outright mistakes. Without rejecting technological innovation, they focus on the priorities needed to develop and improve models and tools. Their claim: prioritize functionality and usefulness before ethics and morality.

Another, more recent contribution suggests that 95% of AI pilots fail to generate tangible value for companies because:

Experimentation happens in isolation, without integrating AI into real operating processes or company data;

Models are tested on incomplete datasets or non-representative scenarios;

There’s no clear adoption strategy or measurement of results.

MIT, however, frames this as a normal stage in the maturity process—which aligns with the universal pattern we’re discussing.

3) Infrastructure

When the idea holds up, the building begins. In today’s startup language: once there’s validation, you invest to build and distribute.

You need railways, power plants, cables, data centers. This is the most expensive phase, the one that separates visionaries from fools. During the electricity revolution, companies spent millions building vast distribution networks without knowing whether anyone would ever buy a toaster.

Today, the story repeats: OpenAI, Oracle, Amazon, Google, and Microsoft are pouring billions into GPUs and data centers, our era’s cognitive power plants.

It’s no longer about inventing. It’s about scaling what’s been invented.

Invention creates potential value. Infrastructure unlocks it.

4) The Dominant Standard

Every revolution reaches a crossroads: whoever sets the standard rules the next decade.

Electricity had the AC/DC wars. Computing had Apple vs. Microsoft. The internet had TCP/IP.

Today, AI is searching for its “Windows moment”: who will set the standard for orchestrating agents, integrating models, and certifying data reliability?

The winner won’t necessarily be the “best” model, but the one that becomes mental infrastructure.

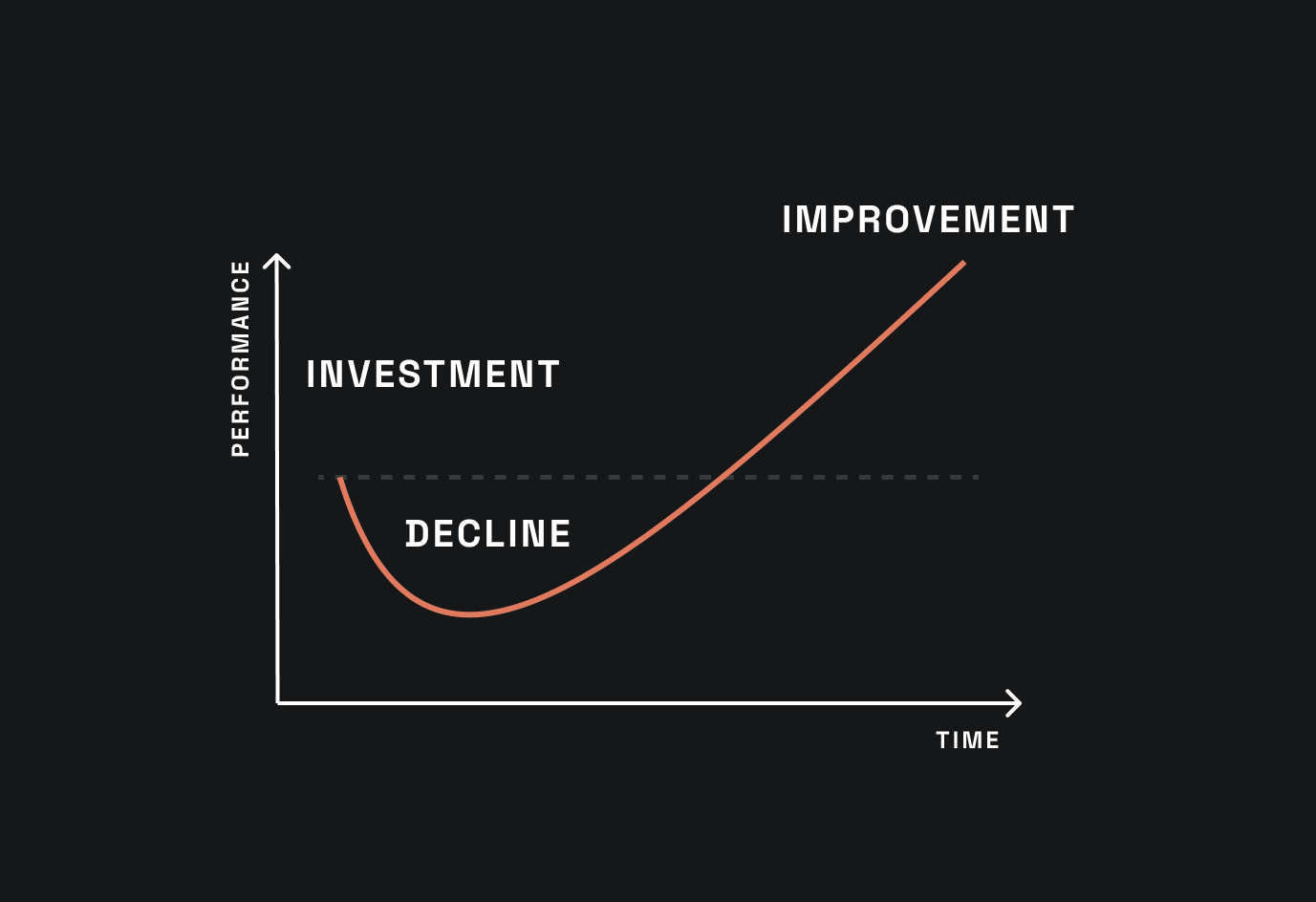

5) Mass adoption and the J-Curve

Profits don’t arrive immediately. The famous J-curve explains it well: investments are high; productivity is initially low.

It takes years for a new technology to seep into processes, habits, and decision-making models. The electricity revolution took thirty years before productivity statistics reflected it.

AI will likely move faster, but the mechanism is the same: those spending without returns today may scale tenfold tomorrow. (The question is: who?)

6) Migration of value

And once everyone uses the new technology, its value disappears from the core. Electricity, the internet, the steam engine, they all became commodities.

Profit migrates to scarce complements: brand, trust, ecosystems, standards, data, distribution.

Historically, that’s where real wealth emerges.

Not in those who produce the model, but in those who embody it, govern it, and make it indispensable.

At first you make money selling the technology. Then you make money using it better than others.

In short:

Productivity gains usually arrive late. First come investment, training, and adaptation.

Final value rarely remains in the core; it migrates to unique complements built on top of the infrastructure (data, integration, trust).

Bottlenecks shift: once it was iron, transport, electricity; today it’s energy, compute, high-quality data, regulation.

This pattern isn’t empty theory, it’s consistent with academic studies on both past and present GPTs.

AI as a Generative GPT: A Faster Leap?

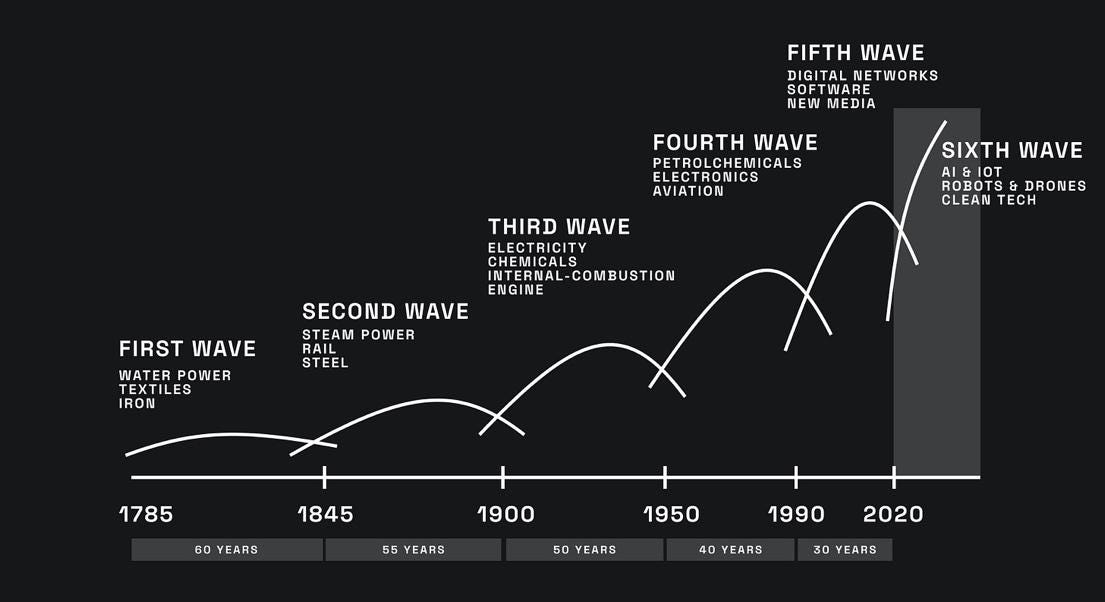

The six waves of recent GPTs.

Many argue that AI, especially Generative AI, is accelerating the pattern, compressing decades into a few years. MIT Sloan writes that AI “could influence economic growth more rapidly than many past GPTs.” The OECD, in a recent June 2025 study, likewise confirms that AI exhibits the typical properties of a GPT and generates vertical and horizontal spillovers across application sectors.

Signals suggest we’re currently in phases 3/4 of the pattern: infrastructure is already (partially) in place, and the first dominant standards and models are emerging. Yet we’re still consolidating infrastructure and remain in the very bottom of the J-curve, where companies are investing enormous sums.

I wrote a deeper dive on capex management and depreciation policies at Big Tech. You can find it here (sorry, it’s in Italian).

The next phases of our pattern will be the most interesting: the upward turn of the curve and, above all, the migration of value.

Industry vs. Finance

During the recent Italian Tech Week in Turin, Jeff Bezos described the dot-com bubble of the early 2000s and drew a parallel to today’s wave of technological innovation.

Notably, our six-stage pattern says nothing about finance.

That’s deliberate. I treat finance as an observer, emotional, impatient, and often ignorant, yet essential and strategic in the journey of innovation. Financial markets anticipate, discount, and demand immediate profits. They crave money, not improvement or innovation.

They lack patience.

As Bezos recalls, during the dot-com bust Amazon’s stock price fell by 95% in short order. Yet while the share price set new, relentless lows, the underlying business, the fundamentals, the KPIs, performances, customer count, recurring purchases, kept improving, and eventually the market recognized it.

Finance exaggerates. It gets carried away, first by excitement and adrenaline, then by fear and panic. Meanwhile, a new technology, a new industry, a new wave is forming, foundations first, then load-bearing walls, then everything else.

What to learn (and what to avoid)

I’m both a personal investor managing my savings and a finance professional managing resources for the company I work for. Here are a few quick, useful takeaways:

Weigh the risk of moving too early into “core” ecosystems and infrastructure that aren’t yet mature.

Assess your position relative to the technology. Are you strong enough to compete in the early phases, or should you wait for value to migrate?

Cut the noise: ignore anyone claiming to already hold “the solution”

Dig all the way down to find what truly matters.

This pattern is my telescope for the future. Past GPTs teach us that the real advantage isn’t the perfect algorithm, it’s knowing how to orchestrate, integrate, and industrialize the wave at scale.

📣 Want to be featured on Open Road Ventures?

If you’re building a tool, service, or promoting an event in the innovation landscape, check out this page to learn how to sponsor a spot in front of 1,400+ engaged innovators. Let’s brew something great together!

Profound. The idea of a 'mental compass' instead of just a historical timeline really resonated, especially thinkinng about AI's trajectory. How might this framework help us better anticipate unintended consequences?

That's a really interesting point of view about technological innovation and what we can wait from them future. Big AI players out there are already investing huge amounts to become the leader in their field. I'm pretty sure that integration among different services and platform could be the key to win this battle.

Now for every task you have to move to a different AI model, using multiple services and losing some part of data.

What do you think about this type of integration?