The Weekly Deal CW12/24 - Composite Recycling

One startup to watch, once a week. Composite Recycling is a Swiss startup that makes Fibreglass reinforced plastics truly circular by recycling composites into reusable fibres.

#material #sustainability #circulareconomy

🥜 In a nutshell

Company: Composite Recycling

Industry: Recycling

Sub-Industry: Composites

Year Founded: 2021

HQ: Ecublens, Vaud, Switzerland

Stage: Series A

Founders: Guillaume Perben, Pascal Gallo

Funding Raised: CHF2M

Funding Round: CHF5M

Main Investors: Industrial, not disclosed

In a sentence: Composite Recycling is bringing circularity to the GFRP industry by efficiently separating resin from fibers, with outputs that can be reused in new high-performance composites and decarbonated plastics, with applications starting with production scrap (from marine, wind, automotive, manufacturing) and expanding to end-of-life fibreglass waste.

🔭 The Context

Composite Recycling answers to the pressing challenges facing the recycling landscape of composite materials. As the use of composites becomes increasingly prevalent across industries such as wind energy, marine, aviation, automotive and electronics, the inability to effectively recycle these materials poses a significant environmental concern.

Traditional methods struggle to separate the fibers from the resin matrix, resulting in wasteful disposal practices and environmental harm. With the demand for sustainable solutions on the rise, EU regulations becoming more strict, and a growing number of composite products reaching the end of their lifecycle, there is a critical need for innovative recycling technologies to address this challenge head-on.

The problem with composites

Currently, composite materials while valued for their lightweight and strength properties, face significant challenges in terms of waste management and recycling. These challenges stem from several factors:

Complex Composition: Composites comprise layers of diverse materials like resins, fibers, and fillers, complicating efficient separation during recycling.

Limited Recycling Infrastructure: Unlike traditional materials, composites lack well-established recycling systems, leading to significant landfill disposal and environmental harm.

Energy-Intensive Processes: Current recycling methods demand high energy inputs, posing economic and environmental sustainability concerns due to emissions and by-products.

Downcycling: Recycled composite materials often degrade into lower-value products, hindering closed-loop recycling and perpetuating the need for virgin materials.

Economic Viability: The economics of composite recycling are challenged by high costs compared to virgin material production, discouraging investment and hindering sustainable practices.

What is Pyrolysis?

Pyrolysis is a thermal decomposition process that breaks down organic materials in the absence of oxygen.

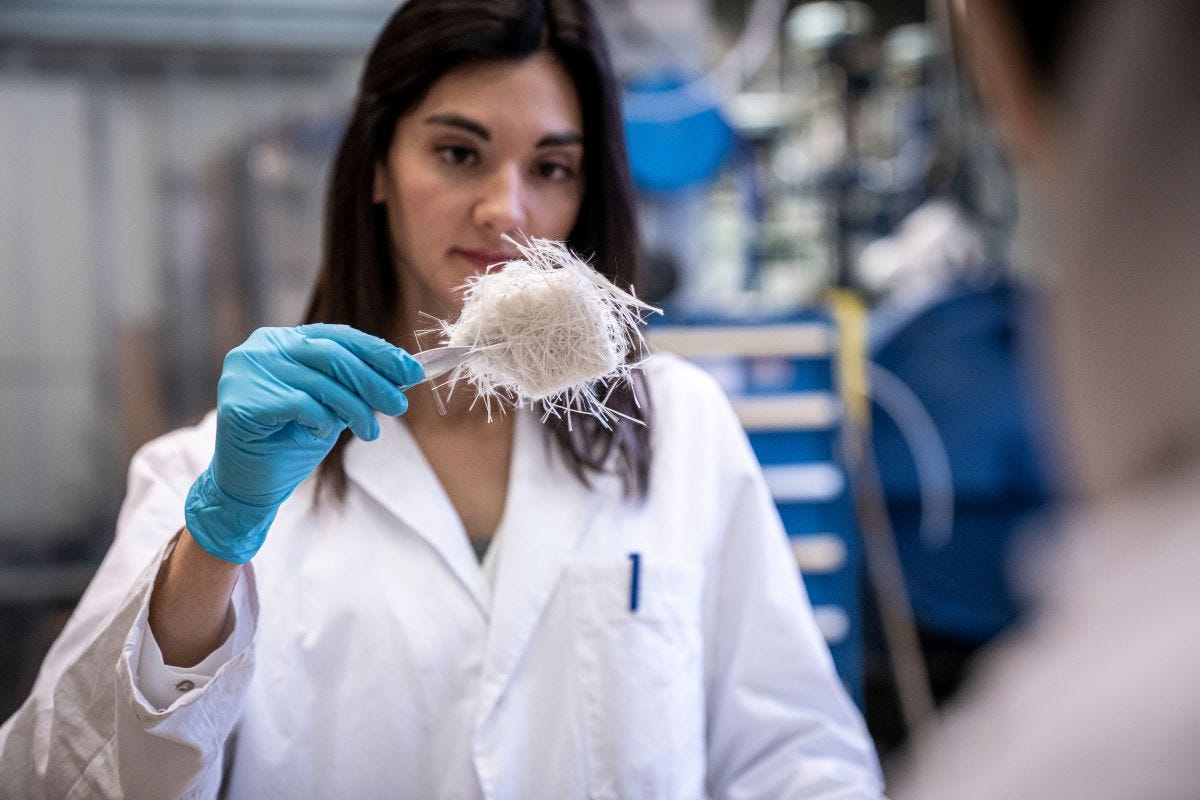

In the context of Composite Recycling, pyrolysis is utilized to separate the fibers from the resin in Glass Fibre Reinforced Plastics (GFRP) waste. This process involves subjecting the GFRP waste to high temperatures in an oxygen-free environment, causing the resin to decompose into gases and leaving behind the intact fibers. The resulting fibers can then be reclaimed and reused in the production of new composite materials, while any byproducts, such as pyrolysis oil and gas, can be repurposed for other applications. Pyrolysis offers an efficient and environmentally friendly method for recycling GFRP waste, contributing to the sustainability goals of Composite Recycling.

Empowering Sustainable Manufacturing Efforts

Their comprehensive services include turn-key recycling solutions, featuring pyrolysis feasibility testing and calibration, followed by mobile and energy-efficient recycling services. They claim to deliver high-quality reclaimed glass fibers suitable for manufacturing new composite materials. Additionally, their pyrolysis oil can serve as a valuable input for producing decarbonized plastics. Through their extensive partner network, they facilitate the reuse of the reclaimed outputs, fostering a circular economy.

With meticulous post-treatment, they ensure optimal quality, consistency, and reusability of the process outputs, including fibers, pyrolysis oil, and gas. Their reactors are calibrated to meet the specifications of partner composite manufacturers, enabling the creation of new composite materials.

Mobile and Energy-Efficient Solutions

Designed to fit within standard 40-foot containers, their pyrolysis reactors offer a mobile solution for on-site treatment of fiberglass waste. This approach minimizes transportation costs, logistical complexities, and carbon emissions associated with waste disposal. By situating reactors near waste stockpiles, such as deconstruction sites and factories, they streamline the recycling process, ensuring fast deployment and efficient operation, capabilities that are urgently required, for example, in the case of harbours damaged by cyclone strikes.

🔍 Some Info

📈 Market Size → $2.2B for CSM Fibres, $1.5B for pyrolysis oil

Composite Recycling operates across three key markets:

They recycle waste composites, tapping into a large and growing market with projected volumes in Europe increasing from 500,000 tons in 2023 to 800,000 tons by 2030.

Their recovered glass fibers contribute to the fibreglass chopped stranded mat market, valued at USD 1.3 billion in 2022 and expected to grow at a CAGR of 8.6% to USD 2.2 billion by 2028. They aim to capture 0.50% of this market by 2028.

They also participate in the pyrolysis oil market, forecasted to grow from USD 1 billion in 2021 to USD 1.5 billion by 2030, with a CAGR of 4.3%. Their target is to hold 0.34% of this market by 2028.

👨🏻🔬 Technology & IP → 1 patent pending

Patent filed on the principle of static pyrolysis treatment and on-site processing via mobile container, national level deployment in process.

🛒 Business Model → B2B

Services: Mobile composite waste treatment, Composite waste materials pyrolysis testing

Products: Reclaimed glass fibers, Reclaimed pyrolysis oil

Revenue sources: Pyrolysis testing, Collection of waste treatment fees, Sale of reclaimed outputs

🤝 Team → 5 Full-time

Guillaume Perben (CEO)

Pascal Gallo (COO / CTO)

Smaranda Jaun (CIRO)

Victoire Radoux (Head of Sales & Projects)

Daphné Beaujoint (Chemistry Intern)

💰 Financials → 2MCHF Seed + 5.1M CHF funding round open

1M CHF in grants, awards and prizes (including MASSCHALLENGE, de Vigier, VentureKick, FIT, and JEC WORLD), and 2M CHF in Seed funding.

With its next funding round now open, Composite Recycling aims to raise a total of 5.1MM CHF with which it will deliver the next three industrial-scale pyrolysis reactors (with a capacity of 4 tonnes per day) by end of 2025.

🥊 Competitors → No-relevant competition is high-end recycling

Composite Recycling operates in a niche of high-end GFRP recycling without relevant competition. Their approach is distinguished by three key aspects:

Unlike other players who downcycle GFRP using shredding or chemical treatments, Composite Recycling preserves the material's structural integrity. This results in recycled outputs retaining their high-performance properties, enabling clients to create new high-performing products with recycled content.

In contrast to competitors requiring the transportation of bulky waste, leading to CO2 emissions, Composite Recycling is mobile, minimizing transport costs and environmental impact.

Competitor's initiatives produce lower quality outputs without ready markets or existing applications. Composite Recycling generates high-quality outputs which seamlessly integrate into clients' existing production lines with minimal-to-no retooling.

❓Q&A with the Team

I had the chance to ask some questions to Guillaume Perben, Co-Founder and CEO at Composite Recycling.

1. Why are you the best team to build this?

Our team is driven by a clear vision: redirecting GFRP waste from landfills to high-value production, benefiting both our clients and the environment. With diverse expertise in physics, chemistry, sustainability, and business administration, coupled with extensive experience in startups, global business development, and finance, we are well-equipped for this challenge. Supported by over 10 industrial partners and academic institutions like EPFL, PSI, and UNFW, we continuously improve our technology. Our business development team collaborates closely with clients and governmental agencies to facilitate the transition to GFRP circularity. Despite the challenges ahead, our shared passion for a world free of GFRP waste fuels our enthusiasm and commitment to this cause.

2. What progress has been made?

Using two prototype machines, we've conducted over 350 pyrolysis tests for dozens of manufacturing clients, proving the recyclability of their products. Among them are 10 industry leaders with revenues exceeding $4 billion. Our pyrolysis testing generated 100k CHF in 2023, a figure we're set to match by March 2024, driving both revenue and awareness.

In 2023, we secured exclusive access to waste boat hull feedstock from French authorities and established partnerships with 10 corporations, including Huntsman Corporation, to cover the entire value chain. Additionally, we've partnered with academic institutions like EPFL, FNHW, and PSI for R&D.

This summer, we'll deploy our first industrial-scale machine, marking a significant breakthrough in circularity for the composite industry.

3. What is your fundraising situation?

In April 2023, we secured a 2MM seed round with key industrial backers, propelling our growth and strategic development. This support facilitated the validation of our recycled fiberglass mat's industrial potential and secured initial downstream clients, earning us the METSTRADE Boatbuilder of the Year Award for Sustainability in 2023.

With this funding, we developed our first industrial-scale pyrolysis reactor (2-tonne capacity per day), scheduled for delivery this month. Its deployment later this summer representating a significant milestone for our company.

We're currently raising a 5MM CHF funding round to scale production of our pyrolysis reactors, meeting the rising demand from various industries. Tightening EU environmental regulations present both urgency and opportunity for our robust solution.

3. What are your next steps?

Our major priority at this stage is scaling up production and deploying our units to meet the demand that is surging as awareness of our solution spreads. Then our challenge will be to expand our team to wisely manage our company's growth - but that's a nice problem to have!

Additional priorities include securing IP protection and participating in the critical industry- and goverment-level discussions that will set the standards and norms for recycling in the EU. For example, in addition to trying to establish business credibility by speaking on expert panels at industry events (like METSTRADE, JEC World, and BOOT Dusseldorf), we are also engaging whenever possible in EU-level discussions about waste management, recycling requirement, and end-of-life protocols - such as the he EU Dialogue on End-of-Life Recreational Craft in Brussels we're attending on March 18. Landfill bans on fibreglass waste will come into force across Europe in the coming years (indeed are already in place in Austria). We want to be ready with the turn-key and compliant solutions for our clients, so they can continue their manufacturing operations without interruption.

Many thanks to Guillaume for the interesting conversation!

👨🏻💻 My Critical View

While Composite Recycling demonstrates promising strides in addressing the pressing challenges of composite material recycling, several considerations warrant investor attention.

Firstly, the scalability of their technology remains a crucial factor, particularly in meeting the surging demand as awareness of their solution spreads. As they embark on scaling production and deploying units, ensuring operational efficiency and maintaining product quality become paramount.

Additionally, navigating the complex landscape of regulatory standards and waste management protocols, particularly within the EU, poses significant challenges. While their participation in industry discussions and strategic partnerships signify proactive engagement, ongoing vigilance and adaptation to evolving regulatory frameworks will be essential.

Furthermore, the economic viability of their solutions amidst the existing disparities between recycling costs and virgin material production costs remains to be seen.

As they continue to raise funds to scale operations, prudent financial management and strategic allocation of resources will be critical for long-term sustainability and growth. Investors should closely monitor Composite Recycling's execution of their growth strategy, technological advancements, and ability to navigate regulatory landscapes to assess their potential for long-term success in the circular economy space.

Stay tuned to discover the next startup on The Weekly Deal!