The Weekly Deal CW14/24 - Eoliann

One startup to watch, once a week. Eoliann leverages satellite data and proprietary ML algorithms to forecast the probability and impact of specific climate risk events.

#climatetech #AI #Insurance

🥜 In a nutshell

Company: Eoliann

Industry: Climate Tech, Insurance

Sub-Industry: AI, SaaS, InsurTech

Year Founded: 2022

HQ: Turin, Italy

Stage: Seed

Founders: Roberto Carnicelli, Chiara Mugnai, Emidio Granito, Giovanni Luddeni

Funding Amount: 1.5M

Main Investors: Primo Ventures, Exor Ventures

In a sentence: Eoliann leverages satellite data and proprietary ML algorithms to forecast the probability and impact of specific climate risk events to improve insurance policy creation and prudential disclosure on ESG risks.

🔭 The Context

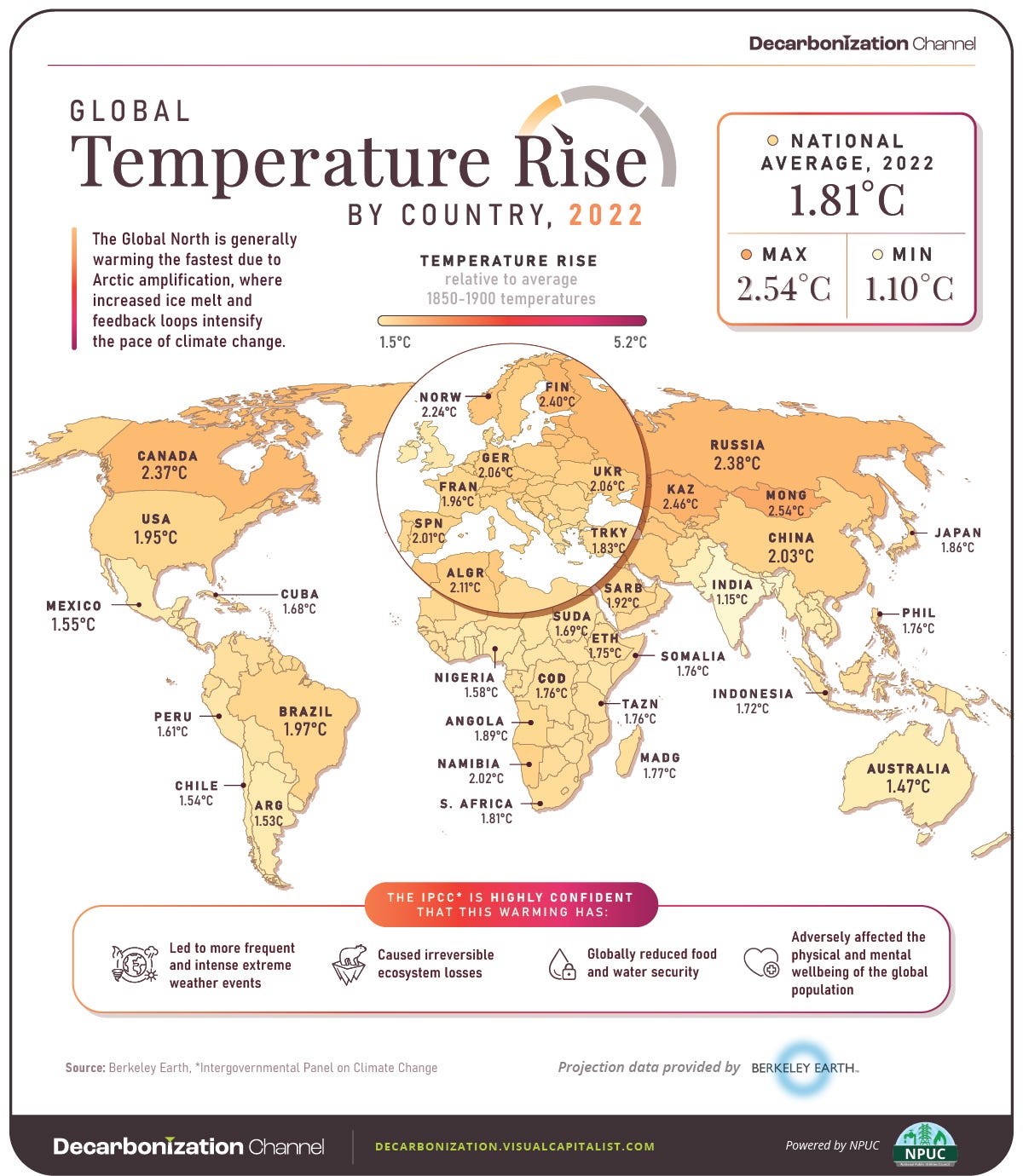

Climate change poses significant challenges to businesses and financial institutions worldwide. Increasingly frequent and severe weather events have led to substantial economic and social losses and underscore the urgent need for proactive risk management strategies.

The urgency of climate risk management is underscored by alarming statistics:

Extreme Climate Events Surge: A staggering +345% increase in extreme climate events between the 1970s and 2010s emphasizes the escalating frequency and severity of climate-related disasters.

Global Economic Losses: Economic losses due to natural-related disasters reached a staggering $343 billion in 2021 alone, highlighting the significant financial impact of climate change.

Insurance Underestimation: Despite the escalating risks, insurance companies continue to underestimate the impact of climate change, with a 40% underestimation of climate-related impacts in 2021.

Traditional risk assessment methods often fall short in accurately predicting and quantifying the impact of climate-related risks. As a result, there's a growing demand for innovative solutions that leverage cutting-edge technologies to provide more accurate and actionable insights.

Eoliann’s Value Proposition

Eoliann stands out as a pioneering force in the realm of climate risk management. By harnessing the power of satellite data, Artificial Intelligence, Machine Learning, and Computer Vision, Eoliann offers a comprehensive suite of solutions to help businesses and financial institutions navigate the complexities of climate risk.

Eoliann’s API enables companies to assess and manage the financial, economic, and social impacts of natural disasters, empowering them to make informed decisions and build resilience in the face of climate uncertainty.

Eoliann Solution in Practice

Emerging Technologies for Climate Impact Management: Eoliann's API assists businesses in making more informed, data-driven decisions to manage their assets' exposure to climate risk. Their primary clients include financial institutions, insurance companies and infrastructure operators.

Addressing Climate Issues: Eoliann's goal is to trigger a new paradigm in climate risk management by researching and modeling climate events and their effects. Their advanced analytics and AI process vast amounts of satellite data to facilitate disaster prediction and impact assessment, laying the foundation for effective, data-driven climate risk management in both the short and long term.

Satellite Imagery and Advanced Analytics: Eoliann's API comprises modules ranging from computer vision algorithms extracting specifics from satellite images to time series data of climate conditions in a given area. These components are integrated into AI physics-based trained models to evaluate the impact of natural events in the area of interest.

ML Algorithm: At the core of Eoliann's software is an algorithm that associates a geographical address with its vulnerability to extreme climate events, in terms of probability and monetary losses. This algorithm provides clients with desired outputs in the form of API, enabling them to have a comprehensive view of their business portfolio's risk.

R&D Partnership Plan: Eoliann aims to collaborate with universities and commercial partners on research and development projects applied to the impact of natural disasters. A co-development partnership is a mutually beneficial solution: Eoliann gains a better understanding of clients' needs, while clients can shape the product based on their specific requirements.

🔍 Some Info

📈 Market Size → 27 Trillion $

The global insurance and risk management industry, particularly focusing on climate-related risks and environmental, social, and governance (ESG) is substantial, with an estimated size of 27 trillion dollars. This represents a vast opportunity for Eoliann to tap into, underscoring the significant potential for growth and impact within their chosen industry.

👨🏻🔬 Technology & IP → In-house developed Artificial Intelligence models

Eoliann core technology and intellectual property revolve around their in-house developed Artificial Intelligence models based on geospatial data analysis. These models serve as the backbone of their platform, enabling them to analyze almost real time satellite data and generate valuable insights for forecasting climate risk events and enhancing insurance policies with ESG considerations.

🛒 Business Model → B2B API Subscription

Eoliann’s business model centers around a B2B API Subscription approach. This means they provide access to their platform and its capabilities via subscription to other businesses, allowing them to integrate Eoliann’s services seamlessly into their own operations. It's a model that fosters mutually beneficial partnerships and ensures their solutions are accessible to those who can benefit from them the most.

🤝 Team → 15 Full-time employees

Roberto Carnicelli - Co-Founder & CEO

Chiara Mugnai - Co-Founder & CDS

Emidio Granito - Co-Founder & CPO

Giovanni Luddeni - Co-Founder & CTO

Overall, Eoliann counts 15 full-time employees with competences in Data Science, Environmental Engineering, Physics, Aerospace Engineering, Finance

🥊 Competitors → ClimateX, Mitiga Solutions, Jupiter Intelligence

ClimateX (UK, Series A): their product, Spectra, is an award-winning climate risk intelligence solution, allowing organisations worldwide to access and integrate granular climate-related physical and transition risk data into their business strategy and meet regulatory disclosures.

Mitiga Solutions (Spain, Series A): Mitiga Solutions provides climate risk intelligence that combines science, AI, and high-performance computing.

Jupiter Intelligence (US, Series C): Jupiter offers climate risk analytics that turns sophisticated climate science into actionable data.

❓Q&A with the Team

I had the chance to ask some questions to Roberto Carnicelli, Founder and CEO at Eoliann.

1. Why are you the best team to build this?

Regarding why our team stands out, we possess all the necessary technical competencies essential for this endeavor. Furthermore, our distinction as the sole Italian entity in the global landscape affords us a unique perspective and a heightened sense of determination. Additionally, our collaboration with the European Space Agency serves as a testament to our credibility and capability, providing invaluable support and resources to bolster our efforts.

2. What progress has been made?

We've achieved quite a bit since we started. Firstly, we've expanded our team significantly, growing from just 4 members to a robust team of 15 experts. Additionally, we successfully raised 1.5 million in funding, which has been instrumental in fueling our growth and development. Moreover, we've reached a significant milestone by releasing our Flood risk predictor, covering the entire continent. And on top of all that, we've secured contracts with major clients in both the infrastructure and financial sectors, solidifying our presence and impact in the industry.

3. What is your fundraising situation?

Currently, we've made substantial progress on the fundraising front. We successfully closed a pre-seed round back in 2022, securing 1.5 million in funding. Looking ahead, we're gearing up to open our next round by the end of this year, aiming to further bolster our resources and propel our growth trajectory.

3. What are your next steps?

Our next steps are focused on several key initiatives. Firstly, we're gearing up for the commercialization of our solution across multiple industries, leveraging its potential impact across various sectors. Additionally, we're eyeing geographic expansion to broaden our reach and address diverse market needs effectively. Moreover, we're actively seeking strategic partnerships to expedite our go-to-market strategy, allowing us to scale efficiently and maximize our impact in the industry.

Many thanks to Roberto for the interesting conversation!

👨🏻💻 My Critical View

For investors evaluating Eoliann's potential, it's crucial to acknowledge the competitive landscape they navigate alongside the immense market opportunity they pursue. Eoliann faces competition from emerging players like ClimateX, Mitiga Solutions, and Jupiter Intelligence, all offering climate risk intelligence solutions bolstered by advanced technologies and market presence.

Nevertheless, amidst this competition, the vast scale of the global insurance and risk management industry, valued at 27 trillion dollars, presents a substantial growth opportunity for Eoliann. Their distinctive approach, utilizing satellite data and proprietary ML algorithms to predict climate risk events, positions them well, offering comprehensive solutions to meet the evolving needs of businesses and financial institutions worldwide.

Moreover, while Eoliann's proprietary AI models and satellite data analysis capabilities appear promising, investors should scrutinize the scalability and reliability of these technologies. Developing and maintaining sophisticated AI algorithms requires substantial ongoing investment in research and development, as well as access to high-quality data sources. Investors should seek clarity on Eoliann's technology roadmap and data acquisition strategies to mitigate risks associated with technological obsolescence or data limitations.

Effectively navigating this competitive arena while capitalizing on the expansive market potential demands strategic differentiation, ongoing innovation, and swift execution. Therefore, closely monitoring Eoliann's ability to differentiate themselves, expand into target markets, and withstand competition is paramount for assessing their long-term viability and investment potential.

Furthermore, conducting thorough due diligence on Eoliann's team dynamics, technology scalability, market demand, and fundraising capabilities is essential for making well-informed investment decisions.

Stay tuned to discover the next startup on The Weekly Deal!