Venturing Insights #27 - The 70/20/10 Innovation Portfolio

Innovation frameworks are like diets. They don’t work if they’re not tailored to your needs.

Previously on Open Road Ventures: In the last episode of Venturing Insights, we discovered the Most Advanced, Yet Acceptable (MAYA) Principle. If you missed it, you can catch up here!

An innovation portfolio is a strategic framework used to allocate resources across a mix of innovation initiatives, balancing core (incremental improvements), adjacent (market expansions), and transformational (disruptive) opportunities. It ensures alignment with organizational goals by managing risk, impact, and feasibility across different time horizons to drive sustainable growth and competitiveness.

For years, the 70-20-10 rule has been heralded as the gold standard for managing innovation portfolios. Originating from Google’s former CEO Eric Schmidt, the model suggests allocating 70% of resources to core innovations, 20% to adjacent expansions, and 10% to transformational, disruptive bets.

It’s easy to see why this framework has caught on—it’s simple, clear, and feels intuitively balanced.

But what if your company isn’t Google? What if your market conditions, competitive landscape, or strategic goals don’t align with this distribution? In today’s volatile, fast-paced business world, blindly following a cookie-cutter approach can be a fast track to irrelevance.

The truth is, innovation isn’t one-size-fits-all. A standardized model can help you start thinking about balance, but thriving companies know the real secret: your innovation portfolio needs to fit your context, not someone else’s.

The Problem with Standardization

The allure of the 70-20-10 rule lies in its simplicity. It offers a neatly packaged approach to innovation—something that feels actionable in the face of complexity. But this simplicity is also its Achilles’ heel.

Research published in Management Review Quarterly points out a critical flaw: no two companies operate in identical contexts. Factors such as industry dynamics, competitive threats, and financial health dramatically influence the “right” innovation strategy. Imagine applying the same playbook to a cash-strapped startup and a market-leading multinational—it’s a recipe for misalignment.

Consider the automotive industry. Traditional manufacturers like General Motors have historically leaned heavily on core innovations: improving existing models. But when Tesla entered the market, the rules changed. Suddenly, transformational innovation wasn’t optional; it became existential.

Rigid adherence to the 70-20-10 split might have been comforting, but it wouldn’t have prepared GM for an electric, autonomous future.

This is the challenge of standardized models: they ignore the nuances that make every company’s journey unique.

A better approach? Tailor your portfolio to align with where your company is today—and where it needs to go tomorrow.

Real-World Adaptation

If the 70-20-10 rule doesn’t fit every scenario, how do companies adapt? The answer lies in rethinking innovation portfolios as dynamic, context-specific strategies. Let’s explore a couple of examples where organizations adjusted their innovation focus based on their unique circumstances.

Case Study: Facebook’s IPO Pivot

Before its 2012 IPO, Facebook was laser-focused on its core operations. Every innovation effort revolved around optimizing the social networking platform and monetizing its massive user base. After the IPO, however, the company shifted gears, using its newfound resources to explore transformative bets, like acquiring Oculus to enter the virtual reality space. This strategic pivot highlights an important principle: your innovation priorities should evolve with your business lifecycle.

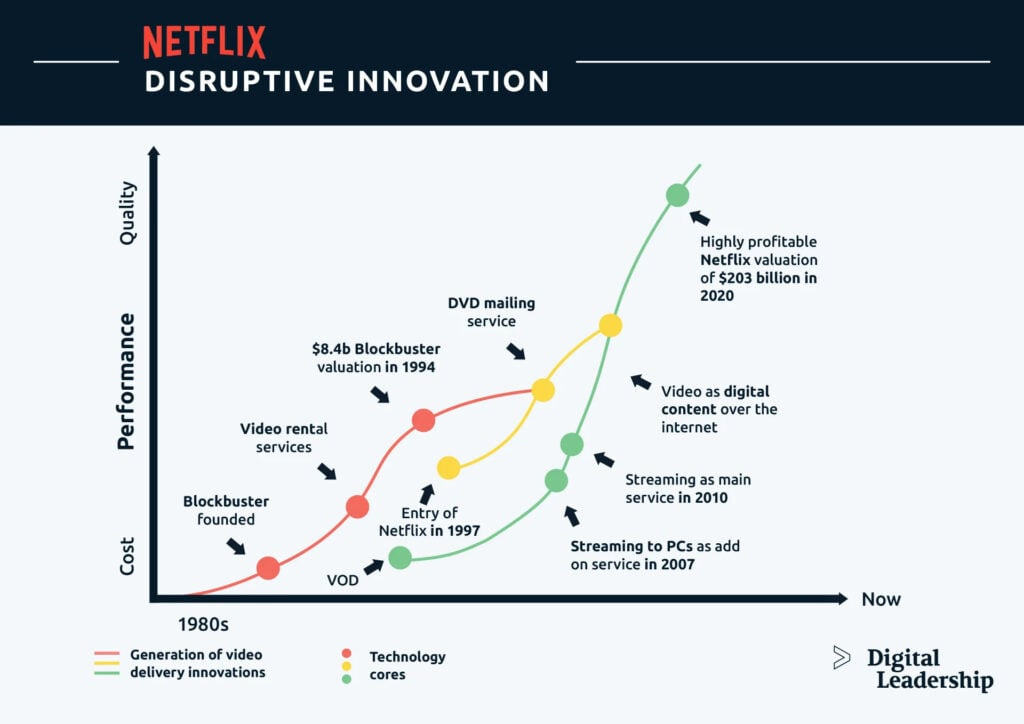

Case Study: Netflix’s Evolution

Netflix’s innovation journey exemplifies adaptability. Starting as a DVD rental service, the company shifted to streaming before doubling down on original content production. By continuously reallocating its innovation resources, Netflix transformed itself from a service provider to a cultural powerhouse, staying ahead of competitors like Blockbuster and Hulu. Their secret? They didn’t just follow a rule—they followed the market.

Both examples illustrate that success in innovation is rarely about static frameworks. It’s about adjusting the balance between core, adjacent, and transformative efforts to seize opportunities and manage risks in real time.

Frameworks for Tailored Innovation

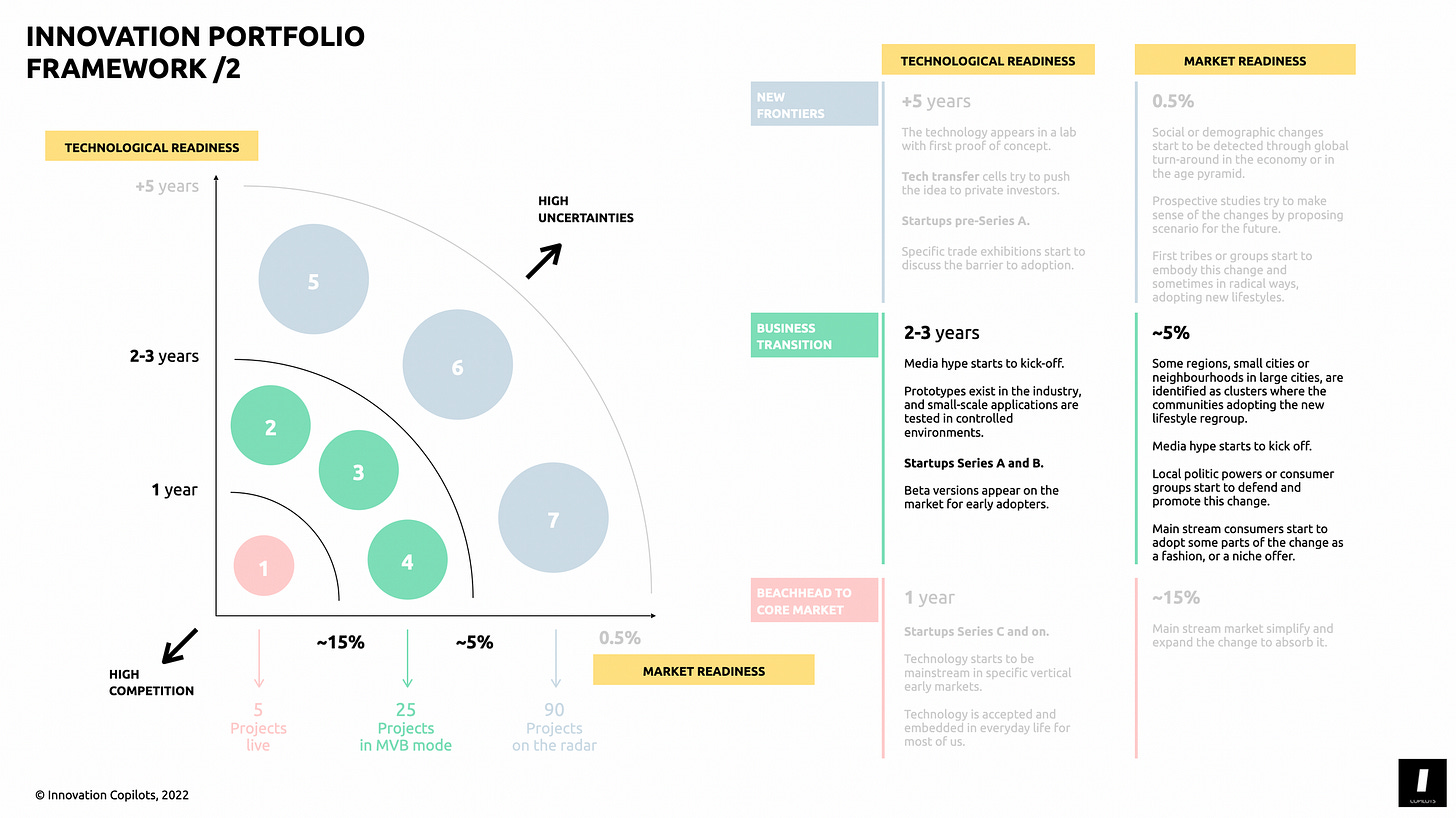

Customizing your innovation portfolio may sound daunting, but several tools and frameworks can help you find the right balance. The goal isn’t just to innovate—it’s to innovate with purpose. To design a robust innovation portfolio, organizations need to balance technological readiness, market readiness, and the feasibility-impact of their initiatives. Combining these two frameworks provides a holistic view of how to prioritize and manage innovation efforts effectively.

Innovation Portfolio Framework

The Innovation Portfolio Framework is valuable because it provides a dynamic approach to managing innovation across time horizons and readiness levels. By balancing projects based on technological readiness (e.g., prototypes vs. mature technologies) and market readiness (e.g., niche vs. mainstream adoption), companies can allocate resources effectively to immediate needs and future opportunities.

This flexibility ensures that innovation investments remain aligned with a company’s strategic goals, whether they’re addressing competitive pressures today or preparing for long-term disruption.

The Impact-Feasibility Portfolio Model

The Feasibility-Impact Matrix is invaluable when combined with the Innovation Ambition Matrix because it adds a layer of prioritization and practicality to ambitious innovation strategies.

While the Ambition Matrix helps allocate resources across core, adjacent, and transformational projects, the Feasibility-Impact Matrix ensures those projects are assessed for their actionable potential. It identifies which initiatives deliver immediate results, which require long-term investment, and which to deprioritize—ensuring resources are not just allocated strategically but also spent wisely. This combination keeps innovation grounded in reality while staying bold in vision.

Avoiding Common Pitfalls

Effective innovation portfolio management requires awareness of common pitfalls:

1. Including daily business tasks in Innovation Mapping: Confusing routine tasks with innovation projects can clutter the innovation portfolio, making it difficult to prioritize truly innovative initiatives.

2. Misinterpreting visions as strategic directions: Broad visions need to be translated into specific, actionable strategic objectives to guide innovation efforts effectively.

3. Misinformed risk levels: Accurately assessing the risk associated with each innovation project is crucial for balanced portfolio management.

4. Treating Innovation Portfolio Management as a One-Time Project: Continuous evaluation and adjustment of the innovation portfolio are necessary to respond to changing market conditions and strategic priorities.

5. Assigning multiple strategic priorities to a single project: Each project should have a clear, singular strategic focus to ensure alignment and effectiveness.

6. Force-Fitting projects under strategic priorities: Align projects genuinely with strategic objectives rather than forcing them into predefined categories.

7. Lack of clarity on project scope: Clearly defining the scope of each project prevents overlap and ensures efficient resource utilization.

By recognizing and addressing these pitfalls, organizations can enhance the effectiveness of their innovation portfolio management.

The Key Takeaway: Don’t treat your innovation portfolio as a one-time decision. Leverage tools like these to regularly assess and adapt your strategy, ensuring it aligns with both internal priorities and external realities.

TL;DR

The 70-20-10 rule might be a popular playbook, but it’s not universal. As Toma points out, your innovation portfolio isn’t a template—it’s a strategy. What works for a tech giant cruising in a stable market won’t cut it for a company bracing for disruption. Market dynamics, financial health, competitive pressures, and even your next big milestone all demand a tailored approach.

The key? Let your strategic intent do the steering.

Ask yourself: What does my company need to win today? What does it need to survive tomorrow? By aligning your innovation portfolio with your unique context, you can ensure that every dollar spent on innovation has a purpose—and a path to impact.

The takeaway is simple: don’t let frameworks drive your strategy; let your strategy reshape the framework. Because innovation isn’t about fitting into a box—it’s about breaking out of one.

As usual, a soundtrack for you: